Carey Olsen is top adviser for funds in the Channel Islands

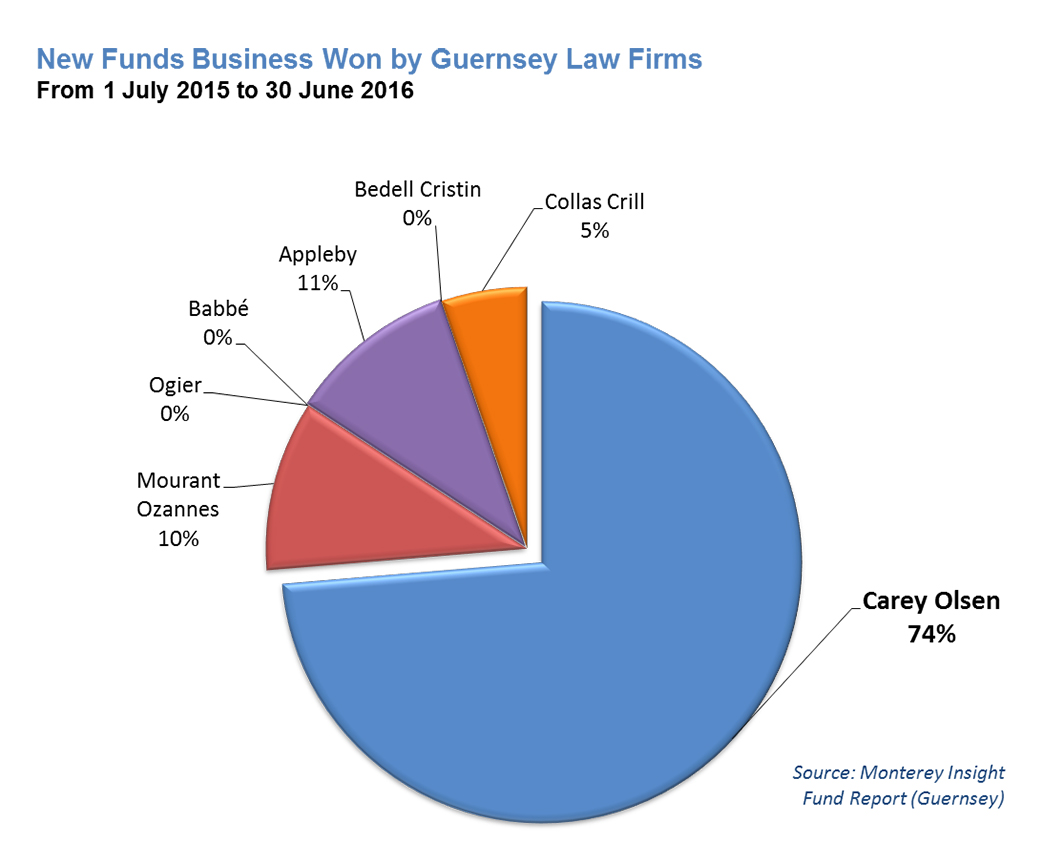

In Guernsey, we advise on 63% of all Guernsey funds, with almost 75% of all new funds last year advised by us too. We now provide legal advice to 670 Guernsey funds (with assets of approximately US$240 billion), with the next Guernsey law firm in the table advising 238 funds (with assets of approximately US$78 billion).

A number of Guernsey’s big fund managers have raised billion dollar funds in the last few months and, in virtually every case, have been massively oversubscribed, which bodes well for the future.

It's a similar story in Jersey where we are the number one adviser for new regulated funds, advising more than twice that of our nearest competitor. Since July 2014, Carey Olsen has advised on 43% of all new funds business in Jersey; over the past year that has risen to 49%.

These are outstanding results and undoubtedly show the clear blue water between ourselves and our competitors. They are testament to our team's hard work and dedication to serving you, our clients and their onshore advisers, and confirm our position as the go to funds teams in Guernsey and Jersey.

As a result, we have been involved in the most significant fund listings and private equity fund raisings in Guernsey and Jersey over the past year, including advising:

- Coller Capital's US$7.15 billion launch of Coller International Partners VII.

- Macquarie Infrastructure and Real Assets (MIRA) on the launch of its latest European infrastructure fund, Macquarie European Infrastructure Fund 5 (MEIF5). The fund closed with €4 billion of investor commitments making it the largest private infrastructure fund raised in Europe in 2016.

- Permira Debt Managers on the final closing of its direct lending fund Permira Credit Solutions II.

- Patron Capital Advisers on the launch of its fifth European real estate fund, Patron Capital Fund V, LP, which recently held its final closing with a total fund size of €948 million (including €143 million of co-investment capital).

- Jersey-based LSE-listed property company Kennedy Wilson Europe Real Estate Plc on the successful close of its £300 million debut senior unsecured bond.

- NTR plc on the successful final close of its new fund which invests in onshore wind projects in Ireland and the UK, with a hard cap investment of €250 million.

Both Guernsey and Jersey are looking to advance their fund regimes to be best-in-class by developing new funds legislation and enhancing links with overseas markets.