Longevity risk solutions post COVID-19

The coronavirus pandemic has already had a significant, direct impact on mortality rates worldwide. That is not surprising. However, market commentators* suggest that its impact on longevity is less clear. That is because indirect effects of the virus could have a positive or negative effect on longevity.

Those indirect effects include the health of the surviving population and the economic, social and political consequences of the steps taken to tackle the virus.

Despite the uncertainty, Guernsey has continued to see significant growth in longevity swap transactions structured through Guernsey cell companies.

Market leader

As set out in our earlier briefing ‘Pension funds: hedging longevity risk’, Guernsey has become a leading jurisdiction for longevity risk transfers as pension funds look to the reinsurance market to transfer longevity risk in order to counter their increasing exposure as a result of increased life expectancy.

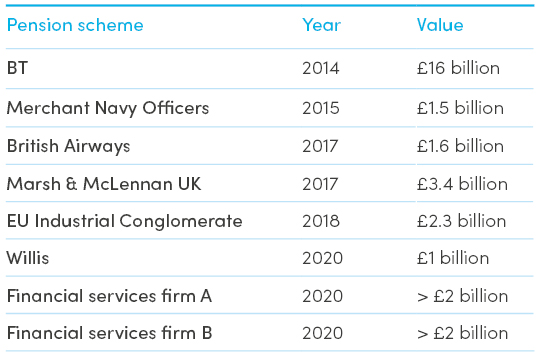

Carey Olsen acted on the first such transaction involving the BT Pension Scheme in 2014 and has advised on every other Guernsey transaction completed since, as set out below.

Substance Impact

Early in 2019, the Economic and Financial Affairs Council of the European Union (ECOFIN) reaffirmed that Guernsey is a cooperative jurisdiction with respect to tax good governance. ECOFIN confirmed that not only does Guernsey meet the international standards of tax transparency, the principles of fair taxation and is committed to fighting base erosion and profit shifting but that Guernsey’s tax regime ensures that profits earned by Guernsey companies are commensurate with actual economic substance in the island.

The implementation by Guernsey of tax substance requirements has not had a material impact on the operating models of the vast majority of Guernsey insurers. This is because:

- local regulatory requirements and the expectations of the Guernsey Financial Services Commission have always required insurers to be managed from Guernsey;

- most Guernsey insurers write risks situated outside of Guernsey and so they have always had to be mindful not to conduct insurance business outside of Guernsey; and

- the boards of most Guernsey insurers contain a majority of Guernsey resident directors.

Consequently, the new requirements have not materially affected the manner in which longevity transactions are documented or transacted.

More innovation

The law underpinning Guernsey’s incorporated cell companies (ICCs), currently requires all those persons who are directors of the ICC to also be the directors of each incorporated cell (IC) thereof. This restriction can sometimes be cumbersome, particularly for ICCs which house a number of ICs, each transacting with different pension funds. In order to address this, it is anticipated that the law will be amended to permit the board of directors of each IC to differ from those on the ICC board and from those on other ICs. The changes are anticipated to be in force later this year – COVID-19 has had a direct impact on their implementation.

* https://www.aon.com/unitedkingdom/retirement-investment/COVID-19/Demographic-Horizons-COVID-19-longevity-impact