Structuring options for holding wealth

Since written records began, we know people have used various structures to hold or own their wealth. In Europe, these were initially aimed at maintaining economically viable parcels of land within (male) family ownership. Later, formal structures for co-investment were developed, from unlimited partnerships subject to written partnership agreements, to unlimited and limited liability companies. Limited liability companies were particularly useful from an investment perspective, because they allowed investors to risk the capital they had agreed to risk but no more.

An original version of this article was first published in IFC Review, July 2025.

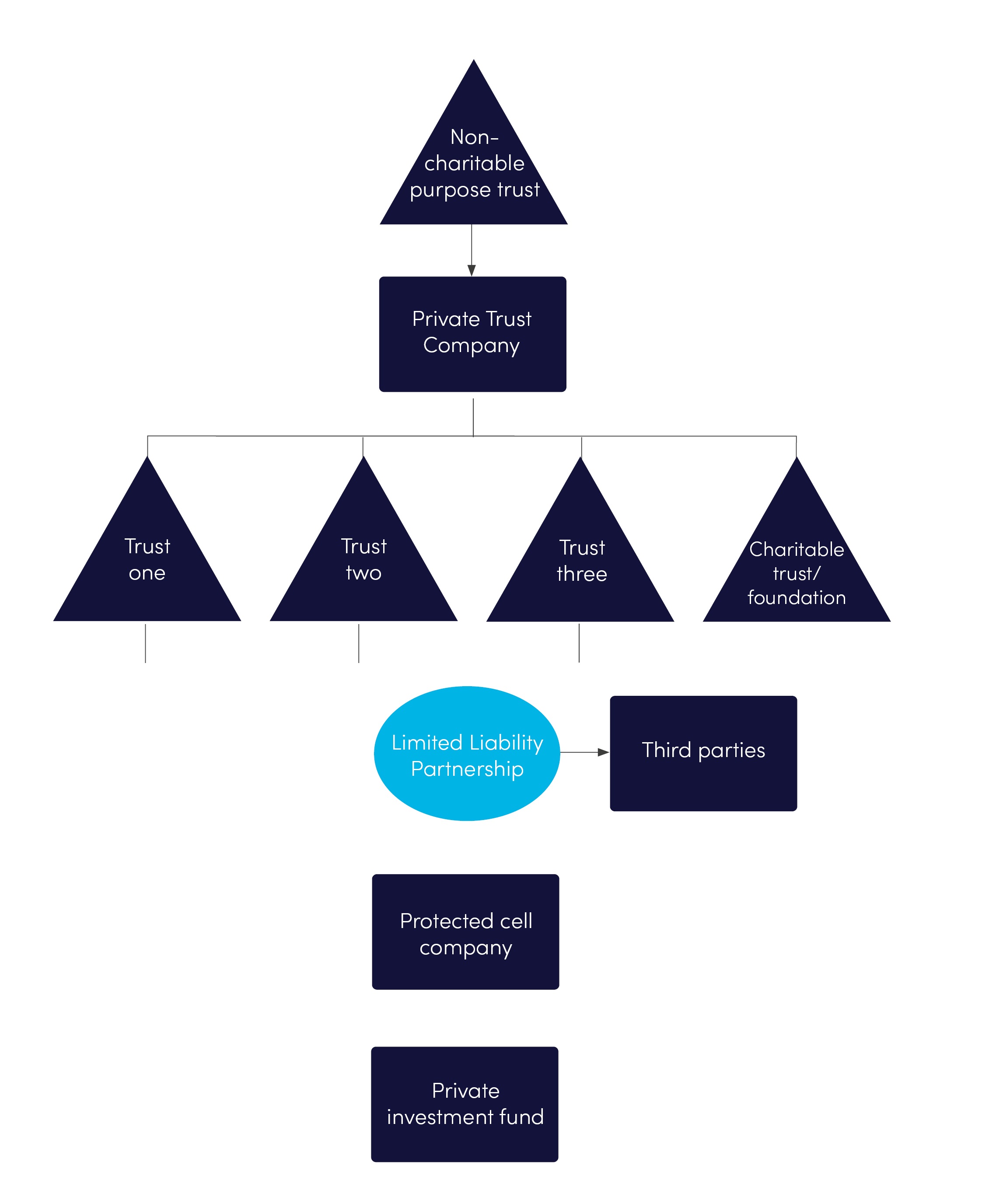

The modern family office has a plethora of structuring options available to it for owning and deploying a family's wealth. This article will explain one of the most popular available in Guernsey, as a well-regulated international financial centre of good standing. This structure is available for all family offices, whether based in Guernsey or not.

-

Non-charitable Purpose Trust: A non-charitable purpose trust is precisely what the name suggests – a trust set up for non-charitable purposes. Traditionally, the law only allowed trusts for the benefit of objects (ie natural and legal persons) and charitable purposes. However, under Guernsey statute, it is possible to create a non-charitable purpose trust. In this typical structure, the purpose of the trust is to hold the shares in the private trust company so that they are not owned by an individual and therefore subject to inheritance issues or other concerns that may arise from individual ownership. Commonly, the trustee of this trust is a regulated Guernsey fiduciary. The enforcer (the person whose role it is to ensure the trustee adheres to the terms of the trust) is often the principal family member or a trusted member of the family office staff.

-

Private Trust Company (PTC): This is a normal limited liability Guernsey company established to act as the trustee of discretionary or reserved power trusts for the benefit of the family served by the family office. Usually, a company acting as trustee by way of business from or within the Bailiwick of Guernsey must be regulated in Guernsey. "By way of business" includes receiving a fee for services even if there is no profit motive. However, a PTC is able to apply for an exemption from licensing if it will only act as the trustee of trusts for the benefit of a specific family, and the administration of the PTC as trustee will be conducted by a regulated Guernsey fiduciary services provider. The advantage of using a PTC over a ‘normal’ regulated fiduciary is that it permits the family to determine who will be the directors and thus have day-to-day control of the trusts. By having a Guernsey fiduciary services provider act as the administrator, the directors can be sure they will be guided on how to exercise the company's fiduciary powers correctly, and the administration of the trusts will be properly managed. Certain records can also be maintained by the family office, providing a degree of privacy for the family.

-

Trusts: Trusts in Guernsey are created and administered under the Trusts (Guernsey) Law, 2007. In the family context, there are usually two types of trust that are established for the benefit of the family. These are discretionary trusts and settlor-reserved trusts:

-

A discretionary trust gives the trustees (the PTC in this example) wide powers to administer the assets of the trust and to distribute them at their discretion to the beneficiaries, ie family members. This provides the trustees with flexibility to adapt to the changing needs of beneficiaries over time. The settlor may guide the trustees’ exercise of their discretions by providing a letter of wishes. The settlor may update their letter of wishes over time. Whilst not legally binding, the letter of wishes sets out how the settlor would like the trustees to manage the trust property. It is normal for trustees to carefully consider the settlor’s wishes in their administration of the trust, and rare for the trustees to depart markedly therefrom. This is particularly so in the case of a PTC where the settlor may sit on the board and/or have chosen their key advisers and trusted members of the family office staff to sit on the board. While the directors must ensure the PTC acts in accordance with its fiduciary duties, they will have a deep understanding of the settlor's rationale for establishing the trusts, and his precise wishes in relation to them.

-

Settlors may retain certain powers over the trust or trust property when they create a trust, such as the power to give binding directions to the trustees in relation to the investment of the trust fund, the power to vary or amend the terms of the trust, the power to remove a trustee, and the power to change the proper law of the trust. Reserved power trusts are often used where a settlor is a successful businessperson and would like to remain actively involved in the management of a business following its settlement on trust. Powers may be reserved in any kind of trust, but care should be taken to ensure that no adverse tax consequences arise as a result. A discretionary trust refers to how the trustees may exercise their dispositive powers (ie that they may exercise them at their discretion for the benefit of any beneficiary). By contrast, a reserved powers trust refers to the level of control or oversight the settlor retains in respect of the administration of the trust and its assets.

-

In the above example, a separate trust has been established for different branches of the family as well as for charitable purposes (see further below).

-

Charitable Trust/Foundation: Most families have philanthropic goals they wish to achieve, and some establish separate philanthropic vehicles for this purpose. A charitable trust can either be established to benefit specific charities and/or specific or general charitable purposes. An alternative to a trust in any context is a foundation. Guernsey's foundation law allows for the establishment of foundations, the advantages of which are that they have separate legal personality and allow for disenfranchised beneficiaries. A disenfranchised beneficiary is one who has no right to any information about the foundation and cannot request the Court's assistance to obtain that information. A foundation must have a registered agent in Guernsey. Where there are disenfranchised beneficiaries or where the foundation is established for purposes, it must have a guardian whose role is to enforce the terms of the foundation in good faith and ‘en bon pere de famille’ (like a good father to his family).

-

Limited Liability Partnerships: Guernsey has three different types of partnerships – general (ie ‘normal’ partnerships in which all partners have unlimited liability), limited (in which the limited partners have limited liability and the general partner has unlimited liability), and limited liability partnerships. This last category of partnership is a legal person with unlimited capacity. It may be formed for any lawful purpose, and carries on business and owns assets in its own name. It must have at least two members (who need not be equal partners), and must have a written agreement to govern the relationship between the members of the LLP itself. The advantage of an LLP over a company for Guernsey tax purposes is that an LLP is transparent. This means all income, gains, and losses, are passed through to its members. The names and addresses of the members of the LLP must be notified to the Guernsey Registrar of Companies, but there is no requirement to file profit-sharing or other account details. In the family structure context, this means it is a useful vehicle for co-investing with third parties.

-

Protected Cell Companies: If the trustee wishes to invest in different assets in different proportions for the benefit of only the trusts of which it is trustee, it could consider using a protected cell company (PCC). The PCC must fall into one of several regulated classes in Guernsey or be administered by, for example, someone with a fiduciary licence. The Guernsey Financial Services Commission must provide its prior written consent to the incorporation of the PCC. The assets of each cell must be kept separate from the assets of the core and from each other. However, the assets may be collectively invested, provided they remain separately identifiable. Third parties must be informed of the specific cell with which they are dealing. If the directors of the PCC fail to do this, they are personally liable to the third party. Thus, this structure provides a great deal of flexibility for investing between branches of the same family.

-

Private Investment Fund: In the example in this article, the fund is a separate vehicle although it could be a cell within the PCC. Guernsey has a flexible regulatory framework for funds involving multiple investors and multiple assets, provided there is no public offering. This includes allowing for regulatory approval within 24 hours, no limit on the number of investors, no requirement for a prospectus or disclosure document, and no requirement for a Guernsey manager (although the legal entity of the fund still has to comply with its regulatory requirements).

This and other structuring options available from Guernsey provide maximum flexibility for family offices serving the needs of ultra-high net worth families. The structures are robust, service providers are well-regulated, and Guernsey is an internationally recognised international financial centre, meaning family offices can have peace of mind because their principals are well-protected.