Guernsey funds and the AIFMD 2

Executive summary

AIFMD 2 will bring significant changes to certain aspects of AIFMD 1. The implications for Guernsey fund managers relate primarily to reporting obligations in respect of Guernsey funds marketed into the EU.

We consider that Guernsey remains an ideal jurisdiction from which to access EU investors (perhaps even more so following AIFMD 2). Being outside the EU, Guernsey managers are not subject to the full regulatory burden of the Directive but will continue to be able to access key EU markets through the national private placement regimes. AIFMD 2 will also not affect access by Guernsey fund managers to the UK investor market.

Introduction

More than 10 years after the first Alternative Investment Fund Managers Directive ("AIFMD 1") was adopted, the EU Parliament and the Council of the EU have agreed on specific amendments to the text of AIFMD 1 (as amended "AIFMD 2"). The proposals are currently expected to come into effect in 2026.

AIFMD 2 does not constitute a total overhaul of AIFMD 1. Nonetheless, there are certain amendments which will impact Guernsey funds.

Summary of the current impact of AIFMD 1 on Guernsey funds

Before considering the impact of AIFMD 2 from a Guernsey perspective, it is worth a quick recap on the key points AIFMD 1 vis-à-vis Guernsey and Guernsey funds.

Overview

- Guernsey is not, and never has been, a Member State of the EU.

- Guernsey funds are classified as "non-EU AIFs" (alternative investment funds).

- Guernsey fund managers are classified as "non-EU AIFMs" (alternative investment fund managers).

- Guernsey funds can be marketed to professional investors in the EU using individual Member States' national private placement regimes ("NPPRs").

The "Reporting Requirements"

- Article 42 is the key Article of AIFMD 1 for Guernsey funds with a Guernsey manager (i.e. non-EU AIF, non-EU AIFM).

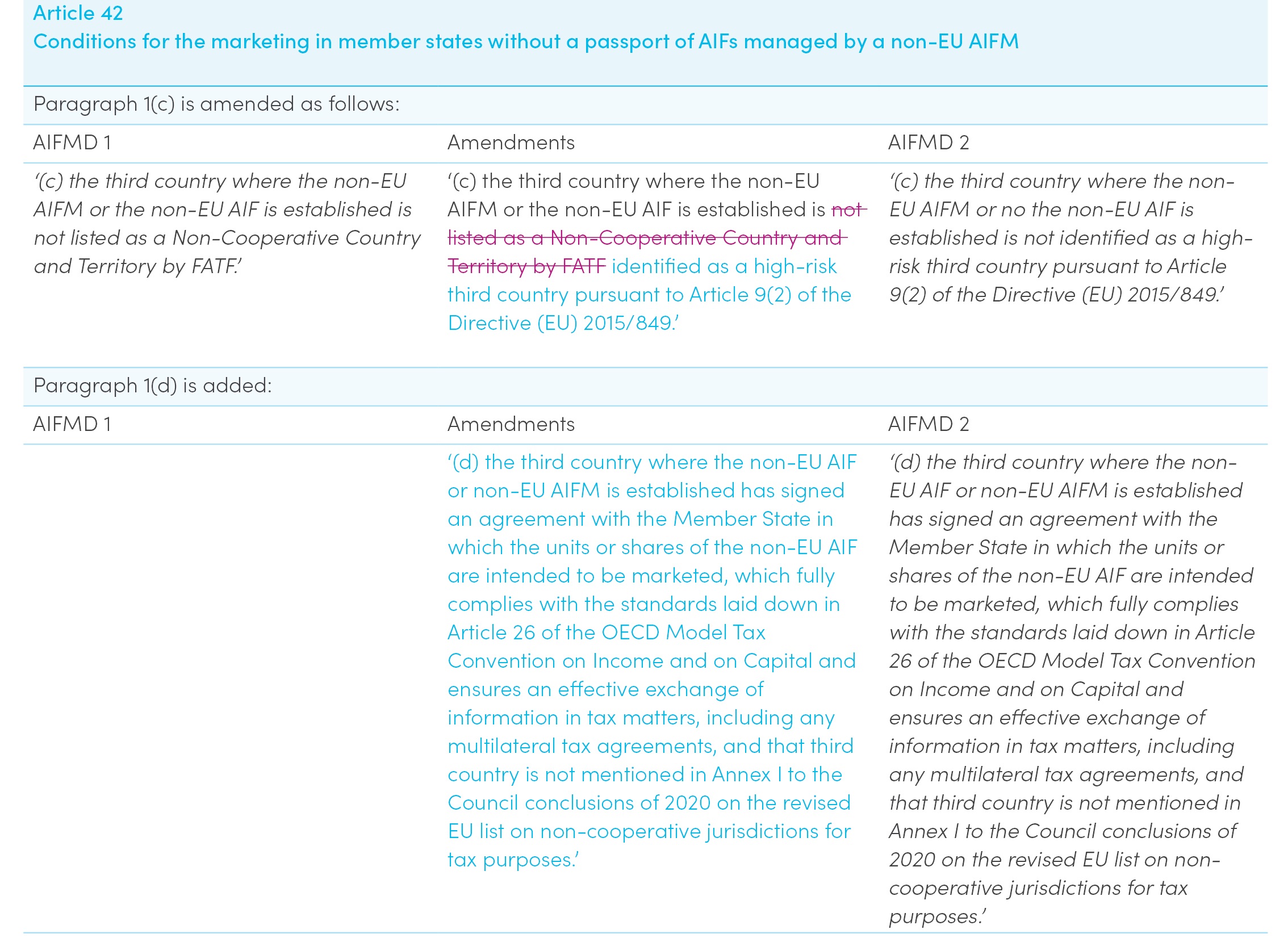

- Article 42 only permits NPPR-based marketing if the third country where the non-EU AIFM or the non-EU AIF is established (i.e. Guernsey) is not listed as a Non-Cooperative Country and Territory by FATF (the "FATF Requirement").

- A non-EU AIFM of a non-EU AIF must comply with:

- any specific requirements of the relevant Member State's NPPR;

- Article 22 – which requires an annual report containing specified information in respect of the fund;

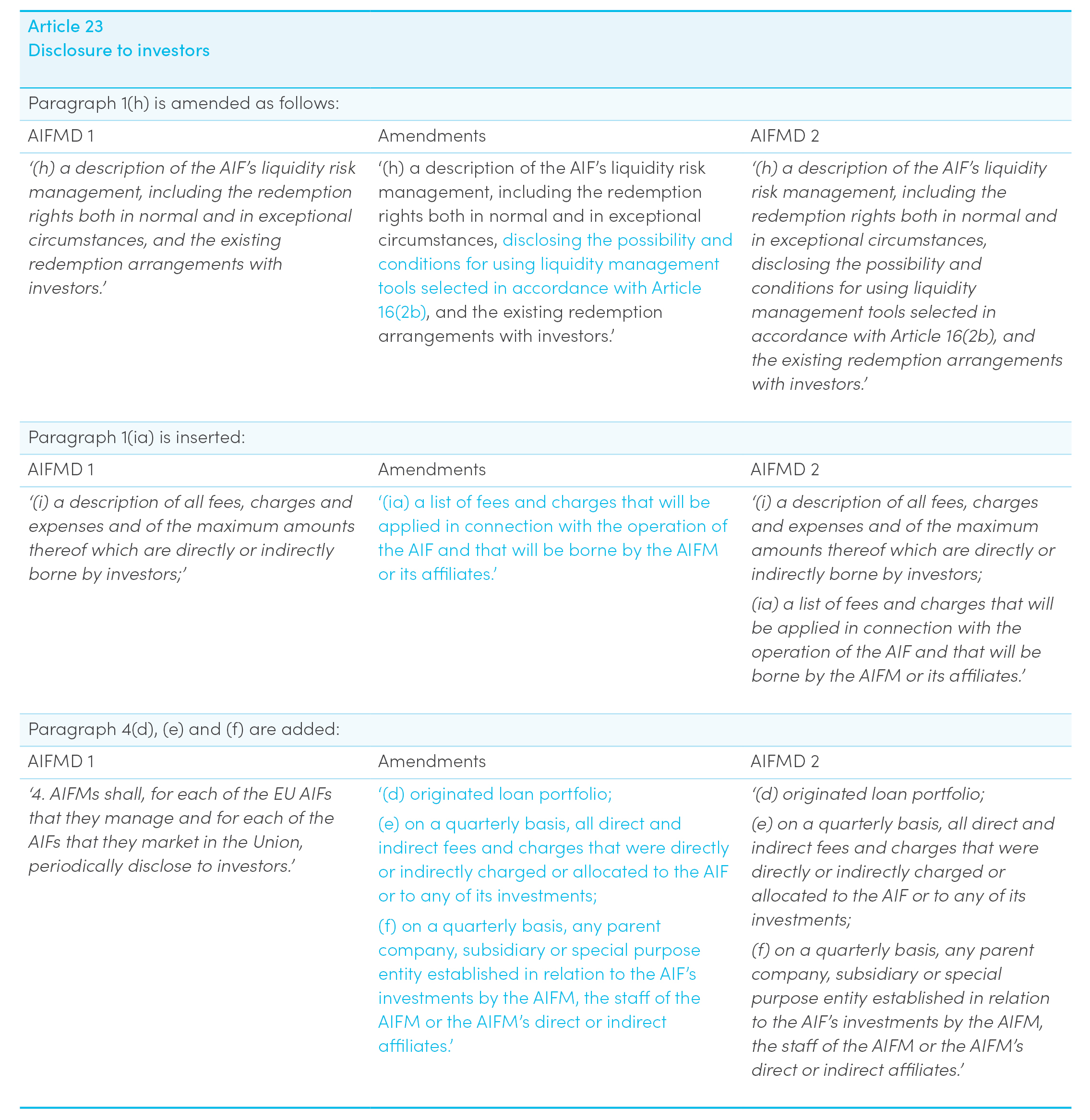

- Article 23 – which requires the disclosure of certain information in respect of the fund to investors both before investing and on an ongoing basis; and

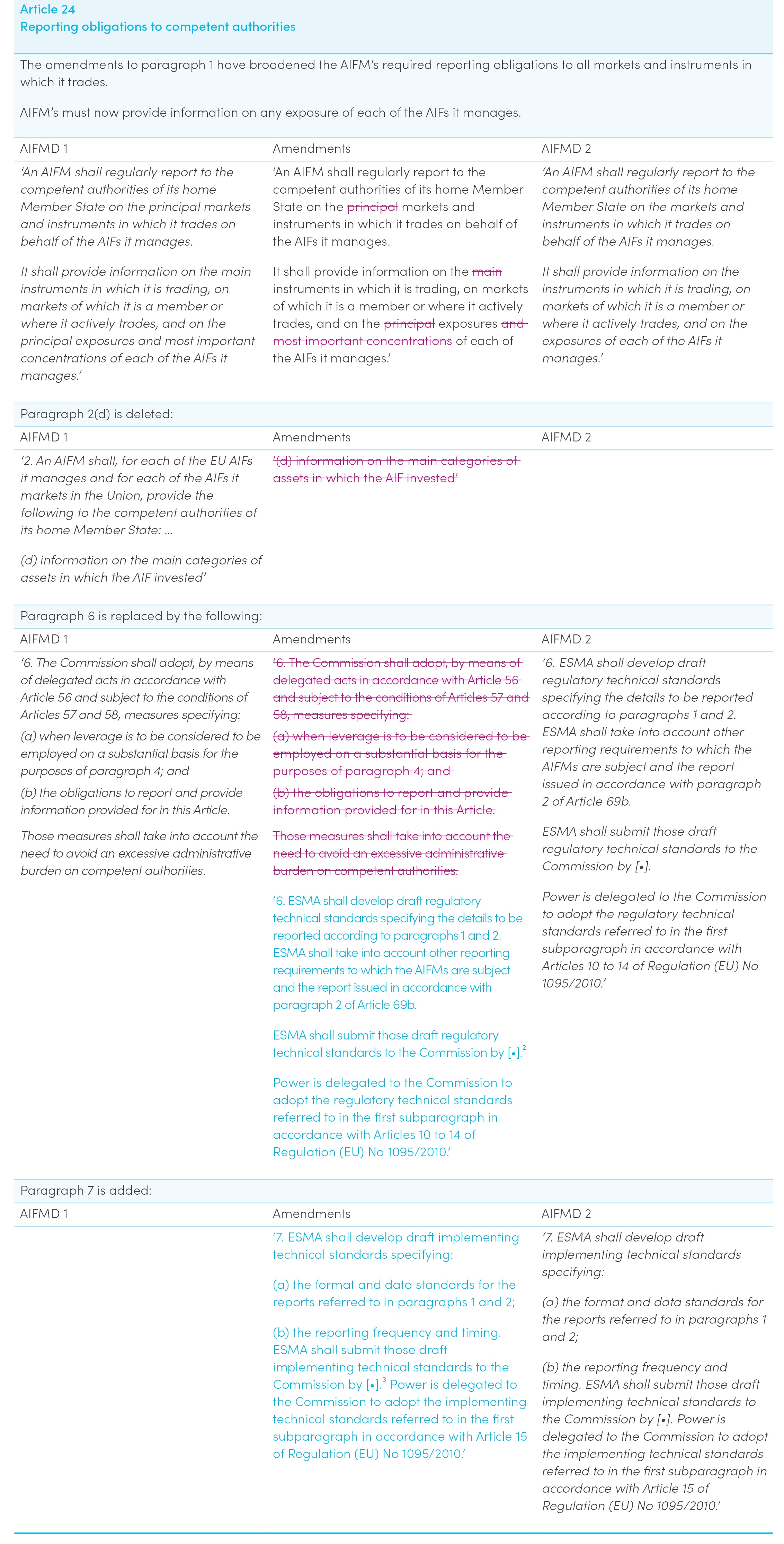

- Article 24 – which requires the reporting of certain information in respect of the fund to the designated Home Member State of the non-EU AIF,

- and, broadly, if the non-EU AIF1 controls larger, non-listed companies: (i.e. the AIF is a buyout fund):

- Article 27 – which requires certain notifications in respect of the acquisition and disposal of major holdings and control of non-listed companies;

- Article 28 – which requires certain notifications in respect of the acquisition of control of non-listed companies and issuers;

- Article 29 – which requires annual reports to contain certain information in respect of the non-listed company controlled by the fund; and

- Article 30 – which precludes certain "asset-stripping" activities in respect of non-listed companies or issuers controlled by the fund.

The "Passport Extension"

Article 67 of AIFMD 1 introduced the potential for the "passport" (permitting access to all 27 EU Member States) to be extended to Guernsey. Back in 2016, Guernsey received an "unqualified and positive assessment" and was approved for the extension of the third-country passporting regime. There have been no further developments on this since the Brexit vote was passed.

What are the key changes made by AIFMD 2?

AIFMD 2 introduces:

- a new regime for "loan origination funds" (i.e. AIFs originating loans), most notably the requirement that such funds are closed-ended unless the manager can demonstrate that its liquidity risk management can satisfy the liquidity terms whilst still complying with its investment strategy;

- additional reporting requirements;

- amended delegation and substance requirements;

- new provisions relating to the fair treatment of investors and undue costs; and

- new provisions relating to conflicts of interest.

What are the key points of AIFMD 2 for Guernsey funds and Guernsey managers?

Replacement of the FATF Requirement

AIFMD 2 replaces the FATF Requirement; access via NPPRs will only be available where the third country where the non-EU AIFM or the non-EU AIF is established is not identified as a "high-risk third" country pursuant to the EU's fourth Anti-Money Laundering Directive.

This should not have any effect on Guernsey funds or Guernsey fund managers.

Amendments to the Reporting Requirements

Significant changes have been made to the Reporting Requirements, with additional, more detailed reporting and disclosure now required in relation to:

- the possibility and conditions under which the liquidity management tools might be used;

- fees, charges and expenses borne by the AIFM in connection with the operation of the AIF that will be borne by the AIF;

- the composition of the originated loan portfolio;

- the current risk profile of the fund, including the market risk, liquidity risk, counterparty risk, other risks including operational risk and the total amount of leverage employed by the fund;

- delegation arrangements; and

- the Member States in which the fund is marketed.

Managers of Guernsey funds should familiarise themselves with these additional reporting requirements as they apply to their funds in advance of AIFMD 2 coming into effect.

A table setting out these changes is available below.

Amendments to the Passport Extension

AIFMD 2 makes no changes to Article 67 and therefore we must assume that the current impasse as regards the extension of the passporting regime to Guernsey fund managers and funds will remain indefinitely.

However, NPPRs have proved highly effective in facilitating marketing in many EU/EEA countries. Guernsey funds continue to be marketed in those countries, thereby avoiding the more onerous and costly requirements of complying in full with AIFMD requirements (such requirements only added to further by AIFMD 2).

Separately, Guernsey continues to enjoy easy access to the major UK investor market, which continues unaffected following the UK’s departure from the EU and which will not, of course, be subject to AIFMD 2. There is no suggestion that the UK will implement similar changes to the UK's regime. However, the FCA has suggested that there will be a consultation on simplifying the existing UK AIFMD during 2024.

Table of AIFMD 2 amendments to AIFMD 1 for non-EU AIFMs and non-AIFMs

1 Per Article 26(1). Note that some of the provisions of Articles 27-30 apply more widely

2 36 months after the entry into force of AIFMD 2

3 36 months after the entry into force of AIFMD 2