Significant Risk Transfers in Guernsey

An unprecedented number of Significant Risk Transfers ("SRTs") were transacted through Guernsey vehicles in 2025. This briefing considers what is an SRT, how financial institutions utilise them and why Guernsey is an attractive jurisdiction for them.

What is an SRT?

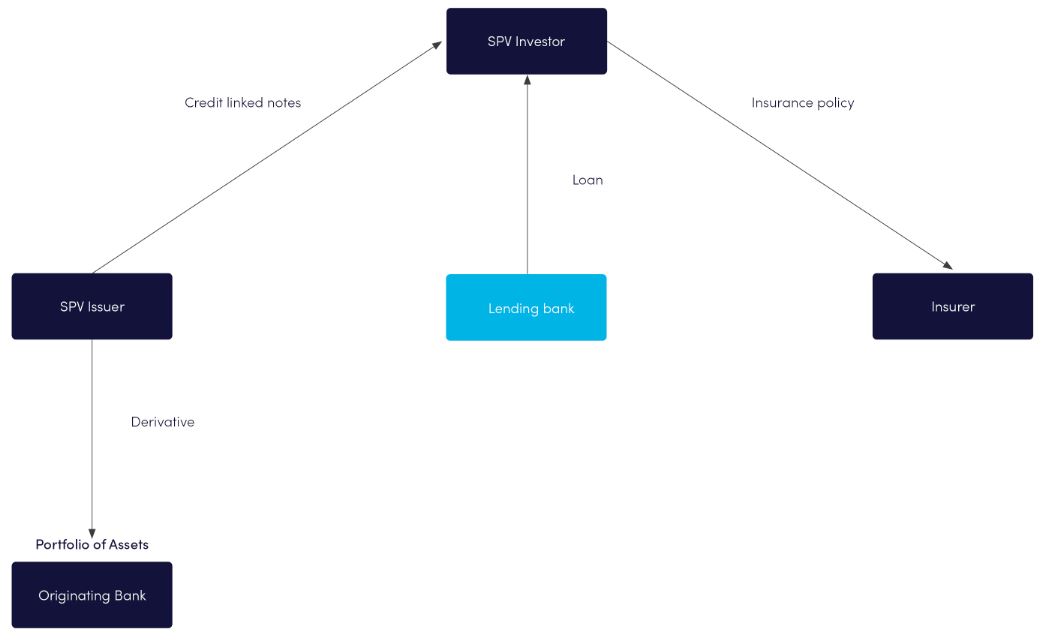

An SRT is a method of transferring risk from a single financial institution (usually a bank) to a wider pool of investors. SRTs are also known as a Credit Risk Transfers ("CRTs"), predominantly in the US. A typical SRT transaction looks like this.

- The originating bank holds a portfolio of assets on its balance sheet.

- An SPV is established which enters into a transaction with the originating bank (often a derivative) in order to gain exposure to those assets.

- The SPV issues to investors tranches of securities (often Credit Linked Notes ("CLNs")) whose performance reflects the performance of the original portfolio of assets.

- The investor borrows from a lending bank in order to fund payment of the issue price of the CLNs.

- Insurance coverage is purchased so that if there is a default under the CLNs, the proceeds of the insurance will cover repayment of the loan plus unpaid interest.

Benefits of an SRT

The main objective of an SRT is capital relief. The SRT can reduce the amount of capital the originating bank is required to maintain by its regulator and free up assets for investment elsewhere, achieving more diversification of risk.

The increased appetite among investors for private credit is another reason why SRTs are popular. The underlying portfolio in an SRT often comprises private credit investments. The insurer gains indirect exposure to those private credit assets through the insurance contract. This can be a more capital efficient way for the insurer to invest in private credit than to hold the assets directly on its balance sheet.

Regulators acknowledge the benefits of SRT transactions. According to the European Central Bank ("ECB"), "[They] help banks to diversify funding sources and transfer credit risk, contributing to a more balanced distribution risk across the financial sector – EU securitisations: 2023 in figures, ECB Supervision Newsletter, 15 May 2024.

Why Guernsey?

Guernsey was the first jurisdiction in the world to introduce legislation permitting the formation of protected cell companies - in 1995. Since then many other countries have introduced similar concepts modelled on the Guernsey original.

When SRTs are structured in Guernsey, the SPV investor usually takes the form of a protected cell of a Guernsey registered protected cell company ("PCC"). This is because protected cells can be established quickly and cheaply, relying on the existing infrastructure of the PCC in which they are housed. We discuss the advantages of protected and incorporated cell companies in this briefing: Cell Companies in Guernsey.

Shares in the cell are usually held by a Guernsey purpose trust to avoid any group consolidation issues. Guernsey also has a reputation as a top tier jurisdiction for trusts.

There are numerous existing PCCs in Guernsey which offer protected cells to clients for a variety of purposes – including SRTs. Historically SRTs were transacted through PCCs which were licensed insurers. Despite this, SRT's do not require to be regulated in Guernsey and so more recent deals have been hosted in unregulated PCCs. This avoids having to obtain regulatory approval for each cell and can mean lower running costs.

The SRT structure described above can also be tweaked to enable a reinsurer with an appetite for private credit risk to participate. A reinsurer is not permitted to write an insurance contract with the SPV investor. However this obstacle can be overcome by interposing a Guernsey licensed SPV insurer between the reinsurer and the Investor SPV. The SPV insurer insures the SPV investor and reinsures 100% of that risk to the reinsurer, allowing it to gain indirect exposure to the underlying portfolio.

Carey Olsen is uniquely positioned to advise on SRTs given its deep insurance and investments expertise. For further information please reach out to your usual Carey Olsen contact or Christopher Anderson, Arya Hashemi, Jamie Oldfield, Imogen Payne or Tracey Powell.