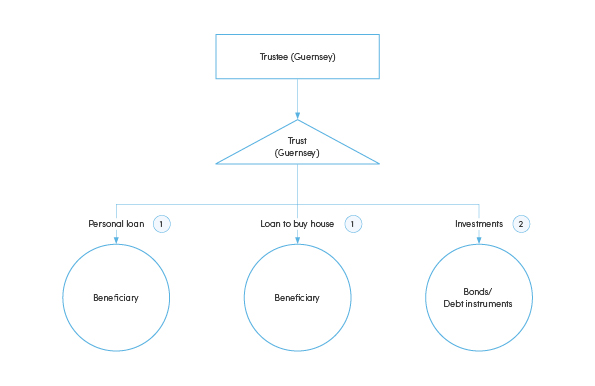

Trust Structure Analysis

Definitions:

"LCF Law" means The Lending, Credit and Finance (Bailiwick of Guernsey) Law, 2022.

"Notice" means the Guernsey Financial Services Commission's Notice with respect to the disapplication of the requirement to hold a licence under section 40 of the Lending, Credit and Finance (Bailiwick of Guernsey) Law, 2022.

-

Personal loan; Loan to buy house

Each loan might be subject to both:

- Part II of the LCF Law, as the provision of credit to a customer under a regulated agreement (as the loan is made to individuals) (in the case of the personal loan, and if the loan to buy a house is in respect of a property outside the Bailiwick) and (if the loan to buy a house is in respect of a residential property in the Bailiwick); and

- Part III of the LCF Law, as "lending" (and thereby constituting the trustee a "financial firm business").

However, as the loan is made to a beneficiary of a trust, the following exemptions apply:

Part II

- Credit to named beneficiaries of a trust. Part II of the LCF Law is disapplied under paragraph V of the first section of the Notice (as this is a Guernsey trustee who extends credit to named beneficiaries of the trust from which the credit is sourced).

Part III

- Lending to named beneficiaries of a trust. Part III of the LCF Law is disapplied under paragraph VI of the second section of the Notice (as this is a Guernsey trustee who extends credit to named beneficiaries of the trust from which the credit is sourced).

-

Investments in bonds / debt instruments

This remains an area of uncertainty in the LCF Law.

Bonds and debt instruments are loans, in that they are (typically) an extension of capital (the initial issue price of the bond / debt instrument), which must be repaid at a later date, under which periodic interest payments (coupons) are paid.

The fact that they also fall within the scope of category 2 (General securities and derivatives) of Schedule 1 (Controlled Investments) to the Protection of Investors (Bailiwick of Guernsey) Law, 2020 does not exempt them from also (potentially) being characterised as a "lending" under Part A (Financial Firm Business) of Schedule 1 of the LCF Law.

The Commission's Feedback following the Commission’s consultation on the Lending, Credit & Finance Rules, Guidance and Implementation issued 19 January 2023 confirmed (at question 22) that debt instruments and bonds are not considered to be “lending” for the purposes of the LCF Law.

However:

- this has not translated into the LCF Law, the Lending, Credit and Finance Rules and Guidance, 2023 or the Notice with respect to the disapplication of the requirement to hold a licence under section 40 of the Lending, Credit and Finance (Bailiwick of Guernsey) Law, 2022; and

where the boundary between "debt instruments and bonds" and lending for the purposes of the LCF Law lies remains unclear.