Carey Olsen advises Rosebank Industries on acquisition of Electrical Components International

Carey Olsen's corporate team in Jersey has represented Rosebank Industries plc ("Rosebank") in connection with its announced acquisition of Electrical Components International ("ECI").

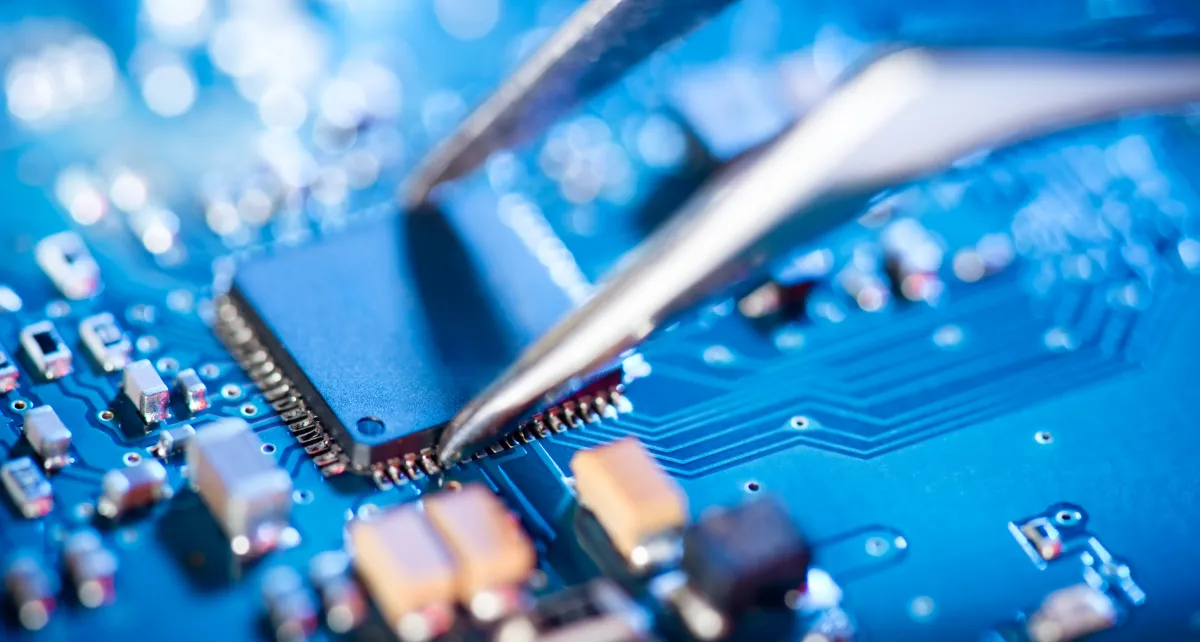

ECI is an electrical components business focused on North America, where it has market leading positions principally producing wire harnesses and controls, often for large blue-chip customers in the industrial, electrification, HVAC and appliance end markets.

ECI will be acquired for cash for an enterprise value of less than US$1.9 billion on a debt and cash free basis. The acquisition will be financed through debt facilities and a fully underwritten institutional capital raise of approximately £1.14 billion.

Established in 2024, Rosebank's strategy is to acquire quality industrial or manufacturing businesses with strong fundamentals whose performance may be improved to create shareholder value. This will be Rosebank's first acquisition under management's successful "Buy, Improve, Sell" model of shareholder value creation via the transformation of industrial businesses in the U.S. and Europe.

The Carey Olsen team included corporate partners David Taylor, Katherine Tresca and associate Jacob Woodhouse, working alongside lead counsel Simpson Thacher & Bartlett.