A guide to funds and private equity in Jersey

As one of the major international finance centres, Jersey has a strong reputation as a prime location in which to establish offshore investment funds. Government determination to encourage high-quality business to the Island, and the support offered by the sophisticated and comprehensive infrastructure of laws and regulations, combine to promote investor confidence.

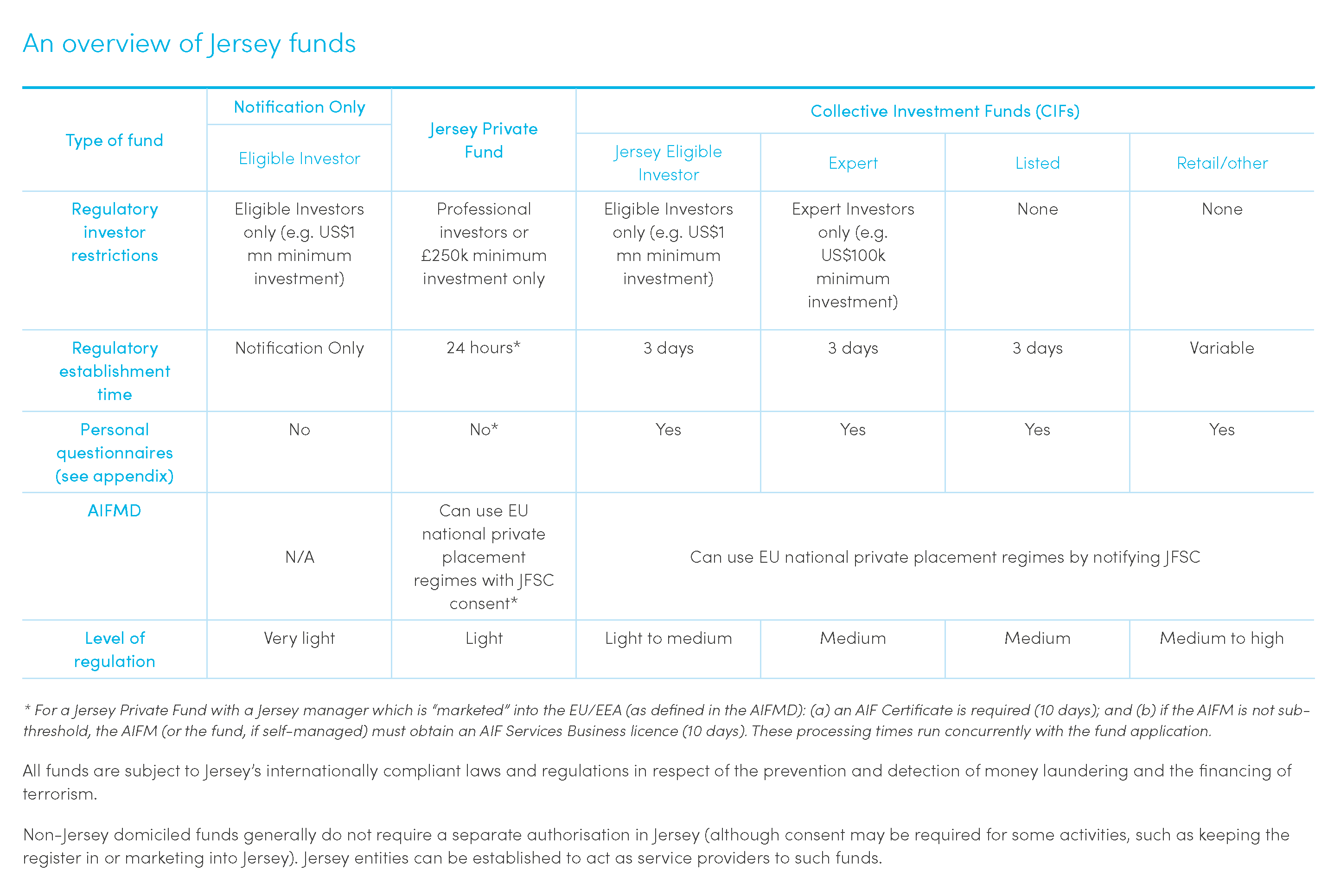

Jersey offers a range of fund types and structures to suit the needs of sophisticated sponsors and investors including Jersey Private Funds, Notification Only Funds (also known as Eligible Investor Funds) and Collective Investment Funds (CIFs), such as Jersey Expert Funds and Jersey Listed Funds.

Our team of leading Jersey funds lawyers have substantial experience advising on the full spectrum of fund strategies and asset classes including private equity, real estate, infrastructure funds, sustainable investment funds, hedge funds, secondaries funds, and a growing digital assets practice.

Please continue reading for our full guide to funds and private equity in Jersey for more information on fund structures available in the jurisdiction and associated regulation.

Carey Olsen

Carey Olsen is a leading offshore law firm advising on the laws of Bermuda, the British Virgin Islands, the Cayman Islands, Guernsey and Jersey from a network of nine international offices.

We provide legal services in relation to all aspects of corporate and finance, trusts and private wealth, investment funds, insolvency, restructuring and dispute resolution.

Our clients include global financial institutions, investment funds, private equity and real estate houses, multinational corporations, public organisations, sovereign wealth funds, high net worth individuals, family offices, directors, trustees and private clients.

We work with leading onshore legal advisers on international transactions and cases involving our jurisdictions.

Our investment funds and private equity team

Clients value our longstanding experience in investment funds and our active role in the market. We advise on all fund structures, including open and closed-ended, limited partnerships, unit trusts and companies in the British Virgin Islands, the Cayman Islands, Guernsey and Jersey.

Recognised as the leading legal adviser to funds across the Channel Islands (Monterey), and with strong Caribbean and Asia practices, we represent more companies and funds listed on the London Stock Exchange than any other offshore law firm (Corporate Advisers Rankings Guide) and regularly advise on listings on the NYSE and HKEx, Euronext, CSX and TISE (formerly the CISE).

We advise credit and debt funds, clean tech funds, real estate funds, retail and listed funds, private equity funds, venture capital funds, hedge funds and infrastructure funds.

Among our clients are fund managers, investment and private banks, institutional investors, boutique investment firms, insurance groups, pension funds, private equity houses and trust companies. We also have longstanding relationships with onshore legal advisers who instruct us on a regular basis. Our lawyers understand the requirements and priorities of each interest group and we tailor our services accordingly. We find innovative solutions and are particularly adept in challenging economic times.

The strength of our relationships with regulators in our jurisdictions means our clients benefit from our in-depth knowledge of the latest developments in regulation and compliance standards.

Our services:

- Fund formation and regulation

- Fund listings

- Mergers, acquisitions and migrations

- Restructurings and reorganisations

- Start-ups and spin-offs

Our approach

Our clients benefit from direct contact with the partner who is leading on their work. Our teams are structured according to the scale and expertise needed for each instruction and we ensure cost efficiencies through the delegation of work to lawyers at the appropriate level.

We make a point of getting to know you, your business and your circumstances; always ensuring our advice is aligned to your ambitions and goals. Our role goes beyond delivering legal services and we aim to contribute to your success and to add value wherever we can. This can take a number of forms including training, knowledge sharing, legal secondments, regulatory and legislative updates and client briefings.

We maintain highly-competitive and transparent fee rates that are visible from the outset.

Jersey: an international finance centre

Jersey is one of the world’s major international finance centres. Its successful combination of stability and reliability combined with tax neutrality has kept Jersey at the forefront of global finance for almost half a century. During this time Jersey has gained a strong reputation as a prime location in which to establish investment funds.

The industry has developed within the Island’s stable political and fiscal infrastructure. Government determination to encourage high quality business to the Island, and the support offered by the sophisticated and comprehensive infrastructure of laws and regulations, combine to promote investor confidence.

The wealth of experience and expertise offered by the Island’s highly skilled financial service providers gives an unparalleled welcome to businesses and investors alike and Jersey enjoys ease of access to the major UK investor market. Although a number of Jersey’s service providers have particular experience with private equity, real estate and funds of funds, Jersey has a growing reputation for more emerging asset classes, including digital assets, ESG-focused strategies and infrastructure funds.

With a business day that begins before Tokyo closes and continues well into New York trading time and a close proximity to Europe whilst retaining independence from the European Union, Jersey offers both location and time zone benefits. Jersey offers seasoned and proven service providers across a variety of disciplines so substance/management of entities can be demonstrated “on the ground” (e.g. administration, accounting, banking and custody providers).

Summary

Jersey is a leading funds domicile:

- Politically and financially stable

- Well known to global investor community

- London time zone and connections

- Many large service providers

- EU market access but outside AIFMD

- Tax neutral

Jersey funds regulation in brief

Jersey regulatory classifications provide a “safe harbour” with 3 day approval from the Jersey Financial Services Commission (“JFSC”) for the majority of non-retail funds.

Alternative Investment Fund Managers Directive

All Jersey funds (other than Notification Only Funds) are eligible to be marketed into the European Union and European Economic Area (“EU/EEA”) in accordance with the Alternative Investment Fund Managers Directive (“AIFMD”) through national private placement regimes and (once available) through the passporting regime. Jersey funds with a Jersey manager which are not actively marketed into the EU/EEA fall outside the scope of AIFMD. See “Alternative Investment Fund Managers Directive”.

Fund categories

Jersey funds are divided into the following main categories:

Jersey Private Fund regime

Fast and flexible:

- No limit on the number of investors or the number of initial offers

- No limit on fund size, no investment or borrowing restrictions

- Open or closed for redemptions by investors

- Open to ‘professional’ investors (any one of 14 categories) and those investing at least £250,000

- Units in a Jersey Private Fund may be eligible for technical listing on an exchange, with the prior approval of the JFSC

- “Fast track” approval by the JFSC in 24 hours (self-certification by the fund administrator)

Without EU marketing

- 24-hour regulatory approval

- No requirement for:

- Audit

- Jersey directors

- A PPM

- No ongoing regulation

EU marketing (sub-threshold Jersey AIFM)

- 10-day regulatory approval

- No requirement for:

- Audit

- 2 Jersey directors

- No ongoing regulation (except limited applicable AIFMD rules)

EU marketing (Jersey AIFM is NOT sub-threshold)

- 10-day regulatory approval

- 2 Jersey directors (or 3, if the AIFM will directly handle client assets)

- No ongoing regulation (except limited applicable AIFMD rules)

Regulated public funds

Suitable for funds where a regulated product is needed:

- 3-day approval (10 days for a new “special purpose” service provider company)

- No investment or borrowing restrictions

- Eligible for EU marketing

Expert Funds

“Expert Investors” only (any one of 9 categories, one of which is an investor of $100,000 or more):

- Open or closed for redemptions by investors

Listed Funds

Closed-ended funds (no absolute investor right to redeem):

- Units listed on an approved stock exchange or market

Eligible Investor Funds

“Eligible Investors” only (any one of 11 categories, one of which is an investor of $1,000,000 or more):

- Open or closed for redemptions by investors

- Must be marketed into at least one EU/EEA country

Notification Only Funds

No regulation means less cost. Cannot be marketed in EU countries (but suitable for all other investors):

- “Eligible Investors” only (any one of 11 categories, one of which is an investor of $1,000,000 or more)

- No authorisation process (simply file a notice)

- No ongoing regulation

- No limit on the number of investors, no investment or borrowing restrictions, no audit requirement for limited partnerships and unit trusts

Investment vehicles which are not funds

Vehicles which hold a single asset or which carry on a business (such as property development) generally fall outside Jersey’s funds regulations. An investment vehicle will not be regulated as a fund in Jersey unless it is a scheme or arrangement for the investment of capital which (a) has as its object or one of its objects the collective investment of capital; and (b) operates on the principle of risk spreading, or units are to be bought back or redeemed continuously or in blocks at short intervals upon the request of the holder and out of the assets of the fund, or units will be issued continuously or in blocks at short intervals.

Fund vehicles

Jersey funds can generally be established as:

- a limited partnership (there are three kinds in Jersey, with and without legal personality);

- a unit trust; or

- a company (including as a protected cell or incorporated cell company).

Special purpose entities as service providers

A “special purpose” Jersey vehicle (“SPV”) can be established to act as manager, investment manager/adviser, general partner or trustee to one or more Jersey or non-Jersey funds.

These SPVs generally do not need to be regulated where they act for Jersey Private Funds or as a general partner or trustee of a Notification Only Fund. It is not usually possible to establish an SPV investment manager/adviser in Jersey for a Notification Only Fund.

Jersey “special purpose” service providers

| GP or trustee | Investment adviser or manager | |

| Jersey Private Fund | Not regulated | Not regulated |

| Regulated Public Fund | 10 day “fast track” regulation | 10-day “fast track” regulation |

| Notification Only Fund | Not regulated | N/A |

Where appointed in relation to a regulated public fund (i.e. a CIF - see the Appendix for more information) an SPV service provider must be licensed by the JFSC. An expedited approval process exists allowing licensing in around two weeks with the support of a local administrator.

See “Fund Service Providers” below.

Jersey Private Funds

A Jersey Private Fund ("JPF") is subject to very light touch regulation and the JFSC does not review the fund's constituent documents.

Key features

- There is no limit on the number of investors or the number of initial offers as long as offers are addressed exclusively to a "restricted group of investors".

- May be open or closed for redemptions by investors.

- Investors must qualify as ‘professional’ investors and/or make an initial investment of at least £250,000, and sign a simple investment warning (usually included in the subscription document).

- No investment or borrowing restrictions.

- Units in a Jersey Private Fund may be eligible for technical listing on an exchange, with the prior approval of the JFSC.

- A Jersey regulated ‘designated service provider’ (“DSP”) must be appointed to ensure that the necessary criteria and applicable anti-money laundering legislation are complied with, to carry out due diligence on the promoter and to file an annual compliance statement.

- A non-Jersey administrator can also be appointed.

- Jersey “special purpose” vehicles established to act as service providers (such as a general partner, trustee or investment manager/adviser) are generally not required to be regulated.

Due to requirements imposed on Jersey as conditions to its EU/EEA market access, additional requirements apply if the fund is actively “marketed” into the EU/EEA (as defined in the AIFMD):

Not actively marketed into the EU/EEA

Where the fund will not be marketed into the EU/EEA:

- JFSC consent obtained in 24 hours.

- No need to prepare an offering memorandum.

- There is no need for Jersey directors or service-providers and no audit requirement.

- The fund is not regulated by the JFSC on an ongoing basis.

Marketed into the EU/EEA the AIFM is sub-threshold

Jersey Private Funds which are to be actively “marketed” into the EU/EEA in accordance with the AIFMD and which have appointed a sub-threshold AIFM:

- An “AIF Certificate” is needed to permit EU/EEA marketing. The ongoing JFSC regulation is limited to compliance with the limited AIFMD provisions relating to third country AIFs.

- For a Jersey AIFM, a simple JFSC consent is required (there is no ongoing regulation).

- Minimal requirements will apply under the Code of Practice for Alternative Investment Funds and AIF Services Business published by the JFSC.

Marketed into the EU/EEA (AIFM is not sub-threshold)

Jersey Private Funds which are to be actively “marketed” into the EU/EEA in accordance with the AIFMD through national private placement regimes (or when available, through passporting):

- An “AIF Certificate” is needed to permit EU/EEA marketing. For the ongoing JFSC regulation is limited to compliance with the limited applicable AIFMD provisions.

- The JFSC assess the suitability of the fund’s promoter having regard to its track record and relevant experience, reputation, financial resources, and spread of ultimate ownership, in light of the level of sophistication of the target investor group.

- Where the AIFM is a Jersey entity (such as a general partner or trustee or an external manager), it must be regulated by the JFSC, in accordance with the AIFMD. See “Fund Service Providers” below.

Expert Funds

Expert Funds are attractive for non-retail schemes, whether hedge funds, private equity funds or other schemes aimed at “Expert Investors”. Expert Funds can be established quickly and cost effectively and must comply with the Jersey Expert Fund Guide (the “EF Guide”).

Approval process

The JFSC does not need to review the fund structure, documentation or the promoter. Instead the fund administrator certifies to the JFSC that the fund complies with the EF Guide and once the certification and the fund’s offer document are filed, the JFSC aims for a 3 day turnaround on the application for approval. The EF Guide provides fund promoters with certainty, efficiency and cost effectiveness in the establishment of a new fund.

What is an Expert Fund?

The definition of “Expert Investor” is crucial. An investor must fall within any one of the 10 categories, which include:

- a person or entity in the business of buying or selling investments;

- a person with a net worth of more than US $1million, excluding principal place of residence;

- a person with at least US $1million available for investment;

- a person connected with the fund or a fund service provider (there is a flexible approach to carried-interest arrangements); or

- (the simplest category) making an investment or commitment of US $100,000 or more (or currency equivalent).

The investment manager/adviser must be:

- established in an OECD member or any other state or jurisdiction with which the JFSC has entered into a Memorandum of Understanding or equivalent;

- regulated in its home jurisdiction (or, if not required to be, approved by the JFSC, which usually occurs on an expedited basis);

- solvent, without convictions or disciplinary sanctions; and

- experienced in using similar investment strategies to those adopted by the Expert Fund.

If the investment manager/adviser does not meet these requirements, it may approach the JFSC on a case by case basis. Of course, if permission is granted then, absent any material change, the investment manager/adviser will not need specific approval to establish further Expert Funds. An investment manager/adviser is not required for certain self-managed funds, such as direct real estate or feeder funds.

A small number of additional requirements are imposed on Expert Funds:

- Two Jersey resident directors with appropriate experience must be appointed to the board of the general partner/trustee/fund company.

- A licensed Jersey administrator or manager (which may be a special purpose vehicle) must be appointed (save in the case of a unit trust where a trustee is often the only required Jersey service provider).

- A Jersey custodian or (in the case of hedge funds) an international prime broker must be appointed for funds which are open for redemption at the option of investors.

- The offer document must set out all material information in respect of the fund.

- Investors must sign a prescribed form of investment warning (usually contained in the subscription document).

- The fund must be audited.

- A Fund Certificate is required regardless of the number of investors.

Flexibility

There are no investment or borrowing restrictions imposed on the fund, nor is there any limitation on the number of investors such a fund may have.

The EF Guide aims to provide a “safe harbour” available to the majority of non-retail funds. On occasion, where derogations from the EF Guide are required, these are considered on an expedited basis.

Ongoing requirements

Ongoing requirements are limited. Future changes to the fund generally do not require regulatory approval unless they are contrary to the EF Guide or there is a change to the fund’s directors or service providers.

AIFMD

Expert Funds are eligible to be marketed into the EU/EEA in accordance with the AIFMD through national private placement regimes (and, when available, third country passporting).

Listed Funds

Listed Funds must comply with the Jersey Listed Fund Guide (the “LF Guide”). The LF Guide does not place any restrictions or qualification criteria on who can invest in a Listed Fund and provides certainty to those wishing to establish a listed fund in a quick and cost-effective manner. There is no minimum investment requirement.

Approval process

Listed Funds are established on certification by the fund administrator that the fund complies with the criteria set out in the LF Guide. The JFSC issues the relevant certificate on receipt of the certification and the fund’s offer document. As a result, a Listed Fund can be established in Jersey within 3 days.

What is a Listed Fund?

A Listed Fund is a fund meeting the following criteria:

- The fund must be listed on an exchange or market recognised by the JFSC. The list of pre-approved exchanges is numerous and global in scope, and includes all exchanges upon which listings are ordinarily sought, including the London Stock Exchange (the Main Market, AIM and the SFM), NYSE, NASDAQ, HKEx, Euronext, Johannesburg Stock Exchange and the TISE.

- The investment manager/adviser must be of good standing, established and regulated (if appropriate) in an OECD member state or a jurisdiction with which the JFSC has memorandum of understanding.

The JFSC understands that some investment managers/advisers may not be regulated because the type of activity they undertake is not regulated in their home jurisdiction: real property investment management being one example. In such cases, provided the investment manager is (i) the subsidiary of an entity that is regulated in relation to managing or advising on investment funds in its home jurisdiction, (ii) an entity or the subsidiary of an entity with a market capitalization of above US $500m, or (iii) a manager with a trading record of at least 5 years or whose principal persons can demonstrate relevant experience or qualifications, it will remain eligible for the fast-track authorisation process. If an investment manager/adviser does not meet these requirements, it may approach the JFSC on a case by case basis. Of course, if permission is granted then, absent any material change, the investment manager/adviser will not need specific approval to establish further Listed Funds. An investment manager/adviser is not required for certain self-managed funds, such as direct real estate or feeder funds.

A small number of key structural requirements are imposed on Listed Funds:

- The fund must be closed-ended (meaning that it is not open for redemptions at the option of investors).

- The fund’s offering document must carry a clear investment warning and contain all information necessary for potential investors to make an informed decision.

- The fund must be audited.

- A licensed Jersey administrator or manager (which may be a special purpose vehicle) must be appointed.

- Adequate arrangements for the safe custody of assets must be in place (though there is no requirement to appoint a custodian).

- A majority of the directors of the board of the fund company (including the Chairman) must be independent. Independence will generally be a matter for the board itself to determine, often using the requirements of any relevant listing authority for guidance.

- Two Jersey resident directors must be appointed to the board of the fund company.

Flexibility

There are no investment or borrowing restrictions imposed on Listed Funds. There is no limit on the number or type of investors in such funds.

The LF Guide aims to provide a “safe harbour” available to the majority of funds which are listed. On occasion, where derogations from the LF Guide are required, these are considered on an expedited basis.

The LF Guide only applies directly to funds structured as companies, but applications for limited partnerships or unit trusts can be made on a case-by-case basis.

Listed Funds are now usually only used if there is a specific desire for a closed-ended listed fund to be regulated or for it to be actively “marketed” into an EU/EEA country in accordance with the AIFMD.

Ongoing requirements

Ongoing requirements are limited. Future changes to the fund generally do not require regulatory approval unless they are contrary to the LF Guide or there is a change to the fund’s directors or service providers.

AIFMD

Listed Funds are eligible to be marketed into the EU / EEA in accordance with the AIFMD through national private placement regimes (and, when available, third country passporting).

Regulated Eligible Investor Funds

Flexibility

Regulated Eligible Investor Funds are similar to Expert Funds in structure, authorisation requirements and ongoing regulation, with the following key differences:

- The fund must be an AIF, for the purposes of AIFMD

- The offering document is not required to comply with the usual disclosure requirements

- All investors must be “Eligible Investors” (see below)

Like Expert Funds, these Funds are attractive for non-retail schemes (including hedge funds, private equity funds and other schemes aimed at “Eligible Investors”) and can be established quickly and cost effectively.

What is an Eligible Investor?

An investor must qualify in any one of 11 categories of “Eligible Investor”, which include those investors:

- who make a minimum initial investment or commitment of US $1,000,000 (or equivalent)

- whose ordinary business or professional activity includes dealing in, managing, underwriting or giving advice on investments (or an employee, director, consultant or shareholder of such a person)

- who is an individual whose property has a total market value of not less than US$10,000,000 or equivalent

- which is a company, limited partnership, trust or other unincorporated association and which either (i) has a market value of US $10,000,000 or equivalent (calculated either alone or together with its associates), or (ii) has only “Eligible Investors” as members, partners or beneficiaries

- which is, or acts for, a public sector body

- which is the trustee of a trust which either (i) was established by an “Eligible Investor”, or (ii) is established for the benefit of one or more Eligible Investors

- which is, or is an associate of, a service-provider to the fund (or an employee, director, consultant or shareholder of such a service-provider or associate and who acquires the investment as remuneration or reward

The regime expressly recognises that a discretionary investment manager may make investments on behalf of investors who do not qualify as “Eligible Investors”, provided that it is satisfied that the investment is suitable for the underlying investors and they are able to bear the economic consequences of the investment.

AIFMD

Regulated Eligible Investor Funds are eligible to be marketed into the EU/EEA in accordance with the AIFMD through national private placement regimes (and, when available, third country passporting).

Retail Funds and other Regulated Public Funds (CIFs)

This category encompasses open-ended funds which are to be offered to retail investors and other CIFs which do not qualify as an Expert Fund, Listed Fund or Regulated Eligible Investor Fund. The first stage of the approval process is the approval of the promoter. This approval can be sought simultaneously with the submission of documents for review by the JFSC. Once such approval has been obtained, any JFSC comments on the documents have been resolved and the JFSC has approved the identity of the fund’s service providers, the JFSC will issue the necessary consents. The extent of the JFSC’s review and of the regulatory requirements it imposes will depend on the nature of the fund and, in particular, on any minimum level of investment or other restrictions on who can invest and whether the fund is open or closed-ended.

Under the JFSC’s published policy, in assessing a proposed promoter or promoting group, the JFSC will have regard to its: track record and relevant experience, reputation, financial resources, and spread of ultimate ownership. Their assessment will depend on the type of investor to which the proposed fund is targeted: the higher the minimum investment and/ or the more that the fund is targeted towards professional or institutional investors who have knowledge of the industry and have the experience and resources to look after themselves, the more the JFSC is inclined to relax their requirements.

Recognised Funds

This category of funds are intended to be freely marketed to retail investors in the United Kingdom or elsewhere and which are generally more heavily regulated than other types of Jersey funds. Recognised Funds are, in practice, rarely established and fall outside the scope of this guide.

Notification Only Funds

Notification Only Funds (also known as ‘Eligible Investor Funds’) may be open/closed-ended and they are restricted to sophisticated investors (including those investing a minimum amount equivalent to US $1 million).

- There is no audit requirement (unless the fund is a company)

- No need for Jersey service-providers or Jersey directors

- No investment or borrowing restrictions imposed on a Notification Only Fund

- No limitation on the number of investors such a fund may have.

The key benefits of this regime for fund promoters are that it provides unparalleled flexibility coupled with the certainty of being able to establish the fund at any time simply by filing the required notice and without the need to obtain JFSC approval.

Notification Only Funds can be established as a Jersey company (including as a PCC or ICC), as a limited partnership with at least one general partner which is a Jersey company or as a unit trust with at least one trustee or manager which is a Jersey company.

A Notification Only Fund:

- can be open or closed-ended and may be sold to or held by an unlimited number of “Eligible Investors”

- does not need to produce audited accounts (unless a company)

- has no need for Jersey service-providers or for any Jersey directors on the fund company, the trustee or the general partner

- has no investment or borrowing restrictions and no limitation on the number of investors

- may be listed, provided that the exchange permits transfer restrictions (to ensure that only Eligible Investors are allowed to invest in the fund)

- must obtain a written acknowledgement from each investor confirming their acceptance of the risks involved in the fund (typically dealt with on the application form)

The 11 categories of “Eligible Investor” are the same as for the Regulated Eligible Investor Fund. Investors must satisfy at least one of those categories.

The regime also expressly recognises that a discretionary investment manager may make investments on behalf of investors who do not qualify as “Eligible Investors”, provided that it is satisfied that the investment is suitable for the underlying investors and they are able to bear the economic consequences of the investment.

Notification Only Funds: the fund vehicle

Once the fund vehicle is established in the usual way, no further regulatory approvals of any kind will be required if the fund meets the requirements for qualifying as a Notification Only Fund. A notice must be filed with the JFSC confirming that the relevant eligibility requirements are met. Existing funds established on or after 19 February 2008 can convert to become Notification Only Funds.

The usual application procedure for incorporating a company or registering a limited partnership will apply, each of which can often be completed on the same working day. Using a unit trust avoids even these requirements. A Notification Only Fund has no obligation to have any Jersey resident directors or any Jersey based administrator, custodian or other service providers.

AIFMD

Notification Only Funds are not eligible to be marketed into the EU/EEA pursuant to the AIFMD. Accordingly, these Funds are most commonly used for raising capital outside the EU/EEA.

Alternative Investment Fund Managers Directive (“AIFMD”)

Jersey is outside the European Union and regarded as a “third country” for AIFMD purposes. Jersey has implemented an AIFMD regime only to the extent necessary to allow Jersey funds and Jersey managers to access investors in EU/EEA countries.

The AIFMD regulation in Jersey overlays the existing regime to provide maximum flexibility. For Jersey funds (and other non-EU funds) with a Jersey Manager:

- Outside AIFMD – where the fund is not an “AIF” or is not “marketed” into the EU/EEA (as defined in the AIFMD), neither the fund nor its manager are subject to Jersey’s AIFMD implementation regime.

- Article 42 requirements only – the fund can be “marketed” into the EU/EEA through national private placement regimes (“NPPR”) by complying with only the requirements of AIFMD Article 42 (annual reports, pre-investment disclosure and regulatory reporting on liquidity, risk management arrangements and leverage). This reduces costs as other AIFMD requirements do not apply, including that no depositary is needed (although a small number of EU/EEA countries require a depository before permitting marketing).

- Full compliance – A Jersey manager can opt for full AIFMD compliance under Jersey’s regime, to be ready for the extension of the AIFMD passporting regime to third countries.

- For Jersey Private Funds, a small amount of additional regulation will be needed (please refer to the ‘Jersey Private Funds’ section, below). However, Jersey Regulated Public Funds (and their AIFMs) are already considered appropriately regulated for these purposes, so they are exempt from the need to obtain any further approvals from the JFSC.

- Notification Only funds cannot be marketed into the EU/EEA, so there is no AIFMD overlay for such funds.

NPPR have proved effective in many EU/EEA countries and Jersey funds continue to be established and marketed in those countries, thereby avoiding the more onerous and costly AIFMD requirements. It is simple and cost effective to establish a “special purpose” Jersey manager with sufficient activity and substance in Jersey for AIFMD purposes. Where required, investment advice can still be received from an onshore advisor.

Jersey has extensive experience with establishing funds and “special purpose” managers for private equity, real estate, and funds of hedge funds, with a growing reputation for more emerging asset classes (e.g. mezzanine and other debt funds and infrastructure funds).

Fund vehicles

A Jersey fund can be established as:

- a limited partnership, separate limited partnership, incorporated limited partnership or limited liability partnership;

- a unit trust; or

- a standard Jersey company, protected cell company or incorporated cell company.

Unit trusts

A unit trust is not a separate legal entity but is constituted by an agreement in writing, commonly known as a “trust instrument”, between a manager and a trustee (or by a trustee which also acts as manager). The trust concept has been recognised in Jersey for over one hundred years and trusts generally are now governed by the provisions of the Trusts (Jersey) Law, 1984. The assets of a unit trust are held by its trustee and are managed by the manager, who may appoint one or more investment managers/advisers to assist it. Contracts in relation to the management and administration of the trust fund will be entered into by the manager, whereas the trustee will enter into contracts in relation to the assets themselves, such as bank deposits, borrowings and security agreements. There is no limit to the number of investors.

Limited partnerships

Limited partnerships (“LPs”) are now the favoured vehicles for closed-ended private equity funds and can be established in three ways:

- “Traditional” Jersey LPs (“JLPs”), which are similar to English LPs, are established under the Limited Partnerships (Jersey) Law 1994.

- Separate LPs (“SLPs”), which have separate legal personality and are therefore similar to Scottish LPs, are established under the Separate Limited Partnerships (Jersey) Law 2011.

- Incorporated LPs (“ILPs”), which have separate legal personality and are bodies corporate, are established under the Incorporated Limited Partnerships (Jersey) Law 2011.

A JLP/SLP/ILP is usually created by a written partnership agreement which is signed after the LP has been issued with a certificate of registration. A JLP/SLP/ILP consists of one or more general partners who are jointly and severally liable for all the debts of the partnership and one or more limited partners, who are not liable for any debts of the partnership beyond the amounts they contribute or agree to contribute. Among the features which make these Jersey LPs attractive to fund promoters as fund vehicles, GP vehicles and carried interest vehicles are the following:

- JLPs are treated as transparent for all UK tax purposes and counsel’s advice is that SLPs will receive the same treatment.

- Jersey LPs are “stackable” – a JLP/SLP/ILP can act as a general partner or limited partner to another JLP/SLP/ILP (or any foreign LP) without prejudicing the limited liability of its limited partners. This makes them ideal for carried interest and other profit distribution structures.

- A JLP/SLP/ILP can distribute both capital and profits without formality provided that it is solvent before and after the distribution.

- The names of the limited partners do not appear on any register which is open to public inspection (public information is limited to the limited partnership’s name and registered office, the general partner’s place of incorporation and registered/principal office and the term, if any, for which the LP is to exist).

- Subject to any requirements of the applicable regulatory category: no Jersey service providers are required; the general partner is not required to be a Jersey company, be resident in Jersey or have Jersey directors, there is no ongoing registration charge, no requirement to file any annual return or accounts and no audit requirement (where the LP is regulated its accounts must be audited but do not need to comply with any GAAP).

- A limited partner may have greater involvement in the affairs of the JLP/SLP/ILP than in some other jurisdictions. There is no limit on the number of limited partners who may be members of a limited partnership. The general partner need not make any capital contribution to the limited partnership.

- There is great flexibility in defining the extent of the limited partners’ rights (including rights of redemption), any rights of any partner(s) to receive carried interest, profit share and/or other payments and the scope of any restrictions on the general partner’s discretion.

- For SLPs and ILPs, the laws under which they are established have been tailored to reinforce the existence of separate legal personality and (for ILPs) body corporate status (e.g. ILPs have perpetual succession and detailed winding up provisions, similar to a Jersey company).

More information on Jersey limited partnerships is available in our briefing on Jersey limited partnerships.

Companies

Companies are incorporated under the provisions of the Companies (Jersey) Law 1991 (the “Companies Law”). Fund companies which are established as open-ended so that investors have the right to realise their investment in the company will normally issue redeemable preference shares to facilitate this, as par or no par value shares.

All companies formed under Jersey law have separate legal personality and are capable of suing and being sued in their own names. Management and control is vested in a board of directors although, particularly in the case of open-ended companies, it is often the case that investment management will be delegated to a management company.

Protected Cell Companies and Incorporated Cell Companies

Cell company structures (which are popular for umbrella fund structures) are also established under the Companies Law. The cells all share the same registered office and company secretary, but can have different boards of directors, different capital structures and different articles of association. In Jersey, two kinds of cell company structure are available:

- The Protected Cell Company (PCC): a “second generation” protected cell company that represents the first significant advance from the PCC model used in other jurisdictions (for example, a cell in a Jersey PCC can invest in other cells within the same PCC) – the PCC and its cells together form a single company, but Jersey’s company law provides for the legal segregation of the assets of the PCC and of each of its cells.

- The Incorporated Cell Company (ICC): a true innovation which provides unmatched segregation of liabilities and flexibility. Each cell of an ICC is a separate company.

PCCs and ICCs can offer significant advantages and recently introduced changes further increase their flexibility, while maintaining the “bankruptcy remoteness” of each cell.

More information on PCC and ICC structures is available in our briefing on Jersey Cell Companies.

The International Stock Exchange

The International Stock Exchange (“TISE”) (formerly known as The Channel Islands Securities Exchange) began its operations in December 2013 replacing the Channel Islands Stock Exchange and provides trading and listing of investment funds, debt instruments and shares in companies. TISE is designed to bring the expertise available in the Channel Islands to the growing number of international businesses requiring first class offshore financial services within the European time-zone.

The TISE provides a listing facility and screen-based trading. The TISE is approved as an Affiliate Member of the International Organisation of Securities Commissions (“IOSCO”). The TISE is officially recognised by the Australian Stock Exchange. The UK Inland Revenue (now “HM Revenue & Customs”) designated the Exchange as a Recognised Stock Exchange under Section 841 of the Income and Corporation Taxes Act 1988 (“ICTA”). Both Jersey and Guernsey are also “Designated Territories” under section 270 of The Financial Services and Markets Act 2000.

Carey Olsen Corporate Finance Limited, a member of the Carey Olsen Group, is a category 1, 2 and 3 Listing Member of the TISE and can act as a fund’s sponsor for listing purposes.

Jersey funds have equivalence on Euronext and Carey Olsen has acted on Euronext listings.

Taxation

The paragraphs below summarise the current tax position in Jersey.

General

Profits of a capital nature are not liable to Jersey income tax (unless arising from the development of land or buildings in Jersey). Accordingly, gains made on the disposal of assets held by a fund by way of investment will not be liable to Jersey income tax. There are no capital taxes in Jersey.

A voluntary exemption from taxation in Jersey is available for fund vehicles, should this ever be considered necessary.

Companies

Jersey fund companies which are resident for tax purposes in Jersey will be subject to income tax in Jersey at a rate of zero per cent. Dividends on shares and redemption proceeds may be paid by the fund company without withholding or deduction for or on account of Jersey income tax and holders of shares (other than residents of Jersey) will not be subject to any tax in Jersey in respect of the holding, sale or other disposition of such shares.

Unit trusts

Funds established as unit trusts are exempt from tax on foreign income and bank interest (either automatically or, where there are Jersey resident individual unitholders, by application).

Unitholders who are not resident for income tax purposes in Jersey are not subject to taxation in Jersey in respect of any income or gains arising in respect of units held by them (other than any Jersey source income excluding bank deposit interest).

Unitholders who are resident for income tax purposes in Jersey will be subject to income tax in Jersey on any income arising from units held by them or on their behalf and income tax is required to be deducted by the trustee(s) on payment of any such distributions.

Limited partnerships

A Jersey limited partnership is not subject to assessment to taxation in Jersey in its own name. The partners are assessed in their own names as follows:

- Investors who are not resident for taxation purposes in Jersey will not be liable to Jersey income tax in practice on distributions from (or interest receivable from a loan made to) the limited partnership and confirmations in this regard are generally obtained from the Comptroller of Taxes in Jersey.

- Investors who are resident for taxation purposes in Jersey are charged to Jersey income tax on the whole of their share of the income profits arising to the limited partnership.

Other taxes

In Jersey, no stamp duty is levied on the creation, transfer, redemption or cancellation of shares, units or limited partnership interests. Stamp duties may be payable in Jersey where such securities form part of the Jersey estate of a deceased individual on a sliding scale at a rate of up to 0.75%. Jersey does not otherwise levy taxes upon capital, inheritances, capital gains or gifts nor are there otherwise estate duties.

Fund service providers

Subject to the requirements applicable to the fund’s regulatory category, the service providers to a Jersey fund can be (i) an established Jersey service provider and/or (ii) a “special purpose” Jersey vehicle which is established to act as manager, investment manager/adviser, general partner or trustee to one or more Jersey or non-Jersey funds and/or (iii) any other (Jersey or non-Jersey) person or entity.

AIFMD

Jersey entities which act as the manager of a fund (the “AIFM” as defined in the AIFMD) are subject to regulation by the JFSC.

- Managers which are already regulated (such as those acting for CIFs) need only comply with the applicable requirements of the AIFMD.

- For other managers (such as Jersey “special purpose” companies establish to act for Jersey Private Funds):

- a ‘light touch’ approach applies where the AIFM will qualify as a ‘sub threshold’ manager (by reference to value of the funds under management);

- otherwise, the usual 10 day application process applies, including prior submission of personal questionnaires.

Jersey depositories are subject to regulation by the JFSC. This service is provided by many established local service providers (and often by the fund’s existing administrator, trustee or custodian).

CIFs: special purpose and other service providers

Jersey service providers to CIFs (including Expert Funds, Listed Funds and Regulated Eligible Investor Funds) must be licensed by the JFSC to conduct “fund services business” under the Financial Services (Jersey) Law 1998 (the “Financial Services Law”): this includes administrators, custodians, distributors, fund managers, investment advisers/managers, general partners and trustees. Established Jersey service providers will already hold these licences.

Notification Only Funds

An exemption from the licensing requirement exists for special purpose companies established in Jersey to act as general partners and trustees of Notification Only Funds, thus ensuring that these structures can remain entirely unregulated by the JFSC (while still being subject to Jersey’s anti-money laundering regulations). It is usually not possible to establish an SPV investment manager/adviser in Jersey for a Notification Only Fund.

Jersey Private Funds

Subject to any AIFMD related requirements (see “AIFMD” in this section, above), special purpose companies established in Jersey are usually exempt from regulation using an applicable exemption, for example:

- for services between “connected companies”;

- an exemption for trustees and general partners; or

- where the fund is a “professional investor regulated scheme”, which requires only that the investor sign a simple specified form of investment warning and either (i) qualify as a “professional investor” or (ii) make a minimum investment of £250,000 or currency equivalent.

Please note that a regulated ‘designated service provider’ will also be needed.

Establishing a special purpose service provider

Where a special purpose Jersey entity needs to be regulated as described above (for example, where acting for a CIF or acting as an AIFM which is not “sub-threshold”), a simplified licensing regime applies:

- The entity must be administered by a regulated Jersey administrator, which assumes responsibility for ongoing regulatory compliance and often provides one or more directors.

- Minimum capital requirement is usually £25,000 (or £10,000 where acting only for one or more related Expert Funds and/or Regulated Eligible Investor Funds), other than for AIFMs where £125,000 is required (increasing where assets under management exceed £250,000).

- Each director of the entity (and each of its beneficial owners with a 10% or greater interest) is required to submit a personal questionnaire (see the Appendix) and obtain approval from the JFSC. As international regulatory checks often take three weeks or more to complete for individuals who have not already been approved by the JFSC, these should be completed and submitted as early as possible.

- Registration under the Financial Services law typically takes 2 weeks (if, as is usual, Personal Questionnaires are filed in advance).

Appendix

What is a CIF?

Only funds which fall within the definition of a “CIF” are required to be regulated by the JFSC under the Collective Investment Funds (Jersey) Law 1988 (the “CIF Law”). These funds may offer their units to an unlimited number of potential investors. Fund structures which are not CIFs must be approved by the JFSC under COBO and (subject to compliance with any approval conditions and to any AIFMD-related requirements) are not regulated by the JFSC on an ongoing basis.

A fund will be a CIF if it has as an object the collective investment of capital acquired by means of an “offer to the public” of units for subscription, sale or exchange, being any such offer:

- which is not addressed to an identifiable category of persons (i) to whom it is directly communicated by the offeror or the offeror’s appointed agent (ii) who are the only persons who may accept the offer (iii) who have sufficient information to make a reasonable evaluation of the offer

- which is communicated to 50 or more persons, or

- where the offered units are to be listed on any stock exchange within one year.

A fund which meets the relevant criteria requires a certificate under the CIF Law if:

- it is a Jersey company or it is a body corporate with an established place of business in Jersey;

- it is a unit trust managed from within Jersey or governed by Jersey law; or

- it is a Jersey limited partnership.

A Jersey Private Fund which meets the requirements of the Collective Investment Funds (Jersey Private Funds) Order 2025, will not constitute a CIF for the purposes of the CIF Law.

A Notification Only Fund is a fund which meets the requirements of the Collective Investment Funds (Unregulated Funds) (Jersey) Order 2008, but which would be a CIF if it did not meet those requirements.

Personal questionnaires

JFSC approval is required for any individuals who are directors of a CIF fund company, general partner or trustee (or who are directors or beneficial owners of any regulated “special purpose” Jersey vehicle such as an investment manager/adviser). As international regulatory checks can take some time to complete, personal questionnaire forms should be completed and submitted as early as possible for any individuals who have not already been approved by the JFSC. This requirement does not apply to Notification Only Funds and Jersey Private Funds.

An overview of Jersey funds

For further assistance or professional advice please, contact one of the Jersey investment fund partners listed on this page or a member of our Jersey investment funds team.

Frequently asked questions

What fund types are available in Jersey?

Jersey offers a variety of fund types ranging from highly regulated to lightly or unregulated structures including Jersey Private Funds (JPFs), Eligible Investor Funds, Expert Funds, Listed Funds, as well as Retail, Regulated, and Recognised Funds.

What are Jersey Private Funds (JPFs)?

JPFs are streamlined, lightly regulated funds for professional or eligible investors and are ideal for fast, flexible fund launches across asset classes.

How have JPF rules changed as of August 2025?

On 6 August 2025, enhancements came into effect that:

- removed the 50 offer/investor limit, although funds may only be offered to a "restricted group of investors" meaning offers are directly communicated only to a specific, identifiable category of investors;

- introduced a streamlined 24-hour authorisation timeframe for consent from the Jersey Financial Services Commission ("JFSC");

- permitted listing of units/shares/interests in a JPF with the consent of the JFSC; and

- widened the definition of a professional investor.

What defines an Expert Fund in Jersey?

Expert Funds are regulated funds that target “Expert Investors” and must comply with the Expert Fund Guide. They benefit from a quick 3-day approval process where the administrator certifies compliance to the JFSC.

What are the criteria for “Expert Investors”?

An investor qualifies as an Expert Investor if they meet any one of the following:

- net worth over US $1 million (excluding primary residence);

- at least US $1 million available for investment;

- invests US $100,000 or more;

- is in the business of buying/selling investments; or

- is connected with the fund or its service providers.

What are Jersey Listed Funds, and how are they regulated?

Listed Funds are closed-ended funds listed on a JFSC-recognised exchange (e.g., LSE, NYSE, TISE) and must comply with the Listed Fund Guide. Approval is fast (as quick as 3 days) once the fund administrator certifies compliance and submits offer documentation to the JFSC.

How does Jersey access EU/EEA markets under AIFMD?

All regulated fund types in Jersey—including Private, Expert, and Listed Funds—can be marketed into the EU/EEA under the Alternative Investment Fund Managers Directive (AIFMD) via National Private Placement Regimes (NPPRs). Jersey managers may also opt into full AIFMD compliance in anticipation of future passporting rights, once available. Sub-threshold managers (under certain asset thresholds) enjoy a more streamlined process, though additional requirements may apply in certain EU member states.

Is setting up a fund in Jersey fast?

Yes

- JPFs are typically approved within 24 hours.

- Expert Funds and Listed Funds usually receive approval in 3 days, based on administrator certifications.

What fund vehicles are supported in Jersey?

Jersey supports a wide range of legal structures for investment funds, including limited partnerships, unit trusts and companies (including cell companies). The most common structure is the limited partnership, often involving a corporate general partner and sometimes a GPLP for tiered structuring. Emerging structures like LLCs are also gaining popularity.