Private Equity Structure Analysis

Definitions:

"LCF Law" means The Lending, Credit and Finance (Bailiwick of Guernsey) Law, 2022.

"Notice" means the Guernsey Financial Services Commission's Notice with respect to the disapplication of the requirement to hold a licence under section 40 of the Lending, Credit and Finance (Bailiwick of Guernsey) Law, 2022.

-

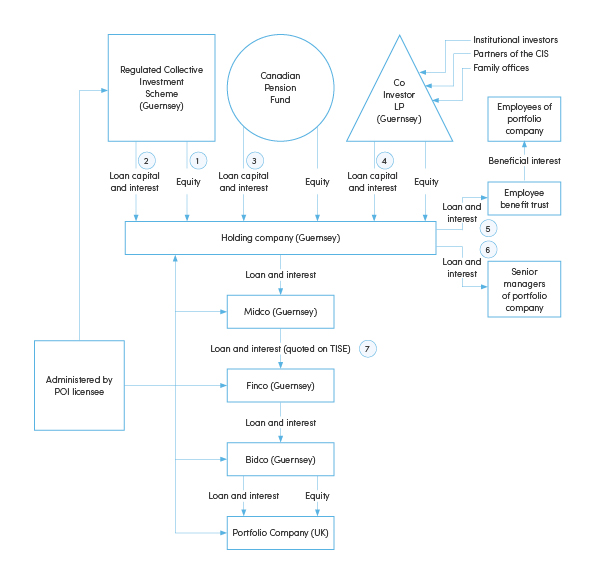

Equity investments

The charts show various instances of equity investments being made. The LCF Law does not apply to equity investments. It possible to structure an equity investment with loan-like characteristics (a fixed, preferential dividend; a set redemption date; priority in a liquidation as against other equity) but not be subject to the provisions of the LCF Law.

-

A loan made by a registered collective investment scheme

This might be subject to Part III of the LCF Law, as "lending" (and thereby constituting the registered collective investment scheme a "financial firm business").

However, the following exemptions apply:

- Regulated business. Under Schedule 1 Part A, paragraph 1(2)(a) of the LCF Law, "financial firm business" carried on by a "regulated business" is not subject to licensing under Part II of the LCF Law. A registered collective investment scheme is a "regulated business" under Schedule 1 Part B, paragraph 24(b) of the LCF Law.

- Loans to shareholders. If a regulated collective investment scheme is a shareholder of the entity to which it lends, paragraph IV of the second section of the Notice exempts "Registered directors, registered partners, registered shareholders, or beneficial owners who carry out lending to associated entities". Note that there is no need that the shareholder be a bona fide shareholder, as is the case for the equivalent exemption in respect of Part II of the LCF Law.

-

A loan made by a Canadian pension fund

This might be subject to Part III of the LCF Law, as "lending" (and thereby constituting the Canadian pension fund a "financial firm business").

However, the following exemptions apply:

- In or from within the Bailiwick. As the Canadian pension fund is not a Bailiwick body, if the activity is not being undertaken either in or from within the Bailiwick, this falls outside the scope of section 16 of the LCF Law and accordingly is not subject to licensing under Part II of the LCF Law.

- Lending by shareholders. If the Canadian pension fund is a shareholder of the entity to which it lends, paragraph IV of the second section of the Notice exempts "Registered directors, registered partners, registered shareholders, or beneficial owners who carry out lending to associated entities". Note that there is no need that the shareholder be a bona fide shareholder, as is the case for the equivalent exemption in respect of Part II of the LCF Law.

-

A loan made by a co-investor established as a Guernsey limited partnership

This might be subject to Part III of the LCF Law, as "lending" (and thereby constituting the Co Investor LP a "financial firm business").

However, the following exemptions apply:

- Lending by shareholders. If the Co Investor LP is a shareholder of the entity to which it lends, paragraph IV of the second section of the Notice exempts "Registered directors, registered partners, registered shareholders, or beneficial owners who carry out lending to associated entities". Note that there is no need that the shareholder be a bona fide shareholder, as is the case for the equivalent exemption in respect of Part II of the LCF Law.

- Lending by an administered entity. Assuming the Co Investor LP is administered by an entity licenced under the Protection of Investors (Bailiwick of Guernsey) Law, 2020, the requirement for the Co Investor LP to hold a licence under Part III of the LCF Law is disapplied under paragraph VII of the second section of the Notice, as either:

- the extension of credit is ancillary to the main activity of the Co Investor LP; or

- extension of credit is one component of an investment, group, or holding structure of which the entity which extends the credit forms a part (where the primary purpose of such a structure is to hold underlying assets, act as a corporate group, or make one or more investments into underlying assets, by equity or by debt, but the primary purpose is not to act as a lender to unconnected third parties).

-

A loan made from Holding Company (Guernsey) to an employee benefit trust (in respect of employees of a subsidiary of Holding Company (Guernsey))

This might be subject to both:

- Part II of the LCF Law, as the provision of credit to a customer under a regulated agreement (as the loan is made to individuals); and

- Part III of the LCF Law, as "lending" (and thereby constituting Holding Company (Guernsey) a "financial firm business").

However, the following exemptions apply:

Part II

- Wholly or mainly outside that individual's trade, business or profession. Part II of the LCF Law applies where credit is extended for to a customer who is an individual acting for purposes wholly or mainly outside that individual's trade, business or profession. Depending upon the nature of the employees' roles, their loans might fall outside the scope of section 2 of the LCF Law and accordingly is not subject to licensing under Part II of the LCF Law.

- Credit to shareholders. On the assumption that the loans are made for the purpose of acquiring shares in the entity making the loans or members of its group, the requirement for the entities to hold a licence under Part II of the LCF Law is disapplied under paragraph III of the first section of the Notice, which exempts "Entities which extend credit to their registered directors, registered partners, registered shareholders, or beneficial owners[1]". We consider that the use of the plural "entities" should be read to refer to a group and therefore "their" directors, registered partners, registered shareholders, or beneficial owners can refer to whichever entity in the group in respect of which they are directors, registered partners, registered shareholders, or beneficial owners – so the shareholders to whom the loan is made does not have to be a shareholder of the specific entity making the loan.

- Credit to employees. The requirement for the entities to hold a licence under Part II of the LCF Law is disapplied under paragraph IV of the first section of the Notice, which exempts "Entities which extend credit to their employees". We consider that the use of the plural "entities" should be read to refer to a group and therefore "their" employees can refer to whichever entity in the group they are employed by – so the employee to whom the loan is made does not have to be an employee of the specific entity making the loan. In addition, the definition of "employee" includes "… an individual … (… who worked under) a contract of employment." Former employees are therefore "employees" under this definition.

- Discretionary Exemption. Non-bank “private lenders” (an "Exempted Private Lender") may be able to apply to the Commission for a Discretionary Exemption from licensing under [Part II] of the LCF Law (a "Private Lender Exemption"). Please refer to our Discretionary Exemption Briefing for further information on the availability of a Private Lender Exemption.

Part III

- Lending to shareholders. On the assumption that the loans are made for the purpose of acquiring shares in the entity making the loans or members of its group, the requirement for the entities to hold a licence under Part III of the LCF Law is disapplied under paragraph III of the second section of the Notice, which exempts "Persons who carry out lending to their registered directors, registered partners, registered shareholders, or beneficial owners". Note that there is no need that the shareholder be a bona fide shareholder, as is the case for the equivalent exemption in respect of Part II of the LCF Law. We consider that the use of the plural "persons" should be read to refer to a group and therefore "their" directors, registered partners, registered shareholders, or beneficial owners can refer to whichever person in the group in respect of which they are directors, registered partners, registered shareholders, or beneficial owners – so the shareholders to whom the loan is made does not have to be a shareholder of the specific person making the loan.

- Lending to employees. The requirement for the entities to hold a licence under Part III of the LCF Law is disapplied under paragraph V of the second section of the Notice, which exempts "Persons who carry out lending to their employees". We consider that the use of the plural "persons" should be read to refer to a group and therefore "their" employees can refer to whichever person in the group they are employed by – so the employee to whom the loan is made does not have to be an employee of the specific person making the loan. In addition, the definition of "employee" includes "… an individual … (… who worked under) a contract of employment." Former employees are therefore "employees" under this definition.

- Lending by an administered entity. As the Holding company is administered by an entity licenced under the Protection of Investors (Bailiwick of Guernsey) Law, 2020, the requirement for the Holding company to hold a licence under Part III of the LCF Law is disapplied under paragraph VII of the second section of the Notice, as either:

- the extension of credit is ancillary to the main activity of the Holding company; or

- extension of credit is one component of an investment, group, or holding structure of which the entity which extends the credit forms a part (where the primary purpose of such a structure is to hold underlying assets, act as a corporate group, or make one or more investments into underlying assets, by equity or by debt, but the primary purpose is not to act as a lender to unconnected third parties).

-

A loan made from Holding Company (Guernsey) to senior managers of a subsidiary of Holding Company (Guernsey)

This might subject to both:

- Part II of the LCF Law, as the provision of credit to a customer under a regulated agreement (as the loan is made to individuals); and

- Part III of the LCF Law, as "lending" (and thereby constituting Holding Company (Guernsey) a "financial firm business").

However, the following exemptions apply:

Part II

- Wholly or mainly outside that individual's trade, business or profession. Part II of the LCF Law applies where credit is extended for to a customer who is an individual acting for purposes wholly or mainly outside that individual's trade, business or profession. Depending upon the nature of the employees' roles, their loans might fall outside the scope of section 2 of the LCF Law and accordingly is not subject to licensing under Part II of the LCF Law.

- Credit to shareholders. On the assumption that the loans are made for the purpose of acquiring shares in the entity making the loans or members of its group, the requirement for the entities to hold a licence under Part II of the LCF Law is disapplied under paragraph III of the first section of the Notice, which exempts "Entities which extend credit to their registered directors, registered partners, registered shareholders, or beneficial owners[2]". We consider that the use of the plural "entities" should be read to refer to a group and therefore "their" directors, registered partners, registered shareholders, or beneficial owners can refer to whichever entity in the group in respect of which they are directors, registered partners, registered shareholders, or beneficial owners – so the shareholders to whom the loan is made does not have to be a shareholder of the specific entity making the loan.

- Credit to employees. The requirement for the entities to hold a licence under Part II of the LCF Law is disapplied under paragraph IV of the first section of the Notice, which exempts "Entities which extend credit to their employees". We consider that the use of the plural "entities" should be read to refer to a group and therefore "their" employees can refer to whichever entity in the group they are employed by – so the employee to whom the loan is made does not have to be an employee of the specific entity making the loan. In addition, the definition of "employee" includes "… an individual … (… who worked under) a contract of employment." Former employees are therefore "employees" under this definition.

- Discretionary Exemption. Non-bank “private lenders” (an "Exempted Private Lender") may be able to apply to the Commission for a Discretionary Exemption from licensing under [Part II] of the LCF Law (a "Private Lender Exemption"). Please refer to our Discretionary Exemption Briefing for further information on the availability of a Private Lender Exemption.

Part III

- Lending to shareholders. On the assumption that the loans are made for the purpose of acquiring shares in the entity making the loans or members of its group, the requirement for the entities to hold a licence under Part III of the LCF Law is disapplied under paragraph III of the second section of the Notice, which exempts "Persons who carry out lending to their registered directors, registered partners, registered shareholders, or beneficial owners". Note that there is no need that the shareholder be a bona fide shareholder, as is the case for the equivalent exemption in respect of Part II of the LCF Law. We consider that the use of the plural "persons" should be read to refer to a group and therefore "their" directors, registered partners, registered shareholders, or beneficial owners can refer to whichever person in the group in respect of which they are directors, registered partners, registered shareholders, or beneficial owners – so the shareholders to whom the loan is made does not have to be a shareholder of the specific person making the loan.

- Lending to employees. The requirement for the entities to hold a licence under Part III of the LCF Law is disapplied under paragraph V of the second section of the Notice, which exempts "Persons who carry out lending to their employees". We consider that the use of the plural "persons" should be read to refer to a group and therefore "their" employees can refer to whichever person in the group they are employed by – so the employee to whom the loan is made does not have to be an employee of the specific person making the loan. In addition, the definition of "employee" includes "… an individual … (… who worked under) a contract of employment." Former employees are therefore "employees" under this definition.

- Lending by an administered entity. As the Holding company is administered by an entity licenced under the Protection of Investors (Bailiwick of Guernsey) Law, 2020, the requirement for the Holding company to hold a licence under Part III of the LCF Law is disapplied under paragraph VII of the second section of the Notice, as either:

- the extension of credit is ancillary to the main activity of the Holding company; or

- extension of credit is one component of an investment, group, or holding structure of which the entity which extends the credit forms a part (where the primary purpose of such a structure is to hold underlying assets, act as a corporate group, or make one or more investments into underlying assets, by equity or by debt, but the primary purpose is not to act as a lender to unconnected third parties).

-

A loan made from Holding Company (Guernsey) to its subsidiary, Midco (Guernsey); a loan made from Midco (Guernsey) to its subsidiary, Finco (Guernsey); a loan made from Finco (Guernsey) to its subsidiary, Bidco Guernsey); a loan made from Bidco (Guernsey) to its subsidiary, Portfolio Company (UK)

Each loan might be subject to Part III of the LCF Law, as "lending" (and thereby constituting each of Holding Company (Guernsey), Midco (Guernsey), Finco (Guernsey) and Bidco (Guernsey) a "financial firm business").

However, the following exemptions apply:

- Lending by an administered entity. As each entity is administered by an entity licenced under the Protection of Investors (Bailiwick of Guernsey) Law, 2020, the requirement for the Holding company to hold a licence under Part III of the LCF Law is disapplied under paragraph VII of the second section of the Notice, as either:

- the extension of credit is ancillary to the main activity of the Holding company; or

- extension of credit is one component of an investment, group, or holding structure of which the entity which extends the credit forms a part (where the primary purpose of such a structure is to hold underlying assets, act as a corporate group, or make one or more investments into underlying assets, by equity or by debt, but the primary purpose is not to act as a lender to unconnected third parties).

- Lending by shareholders. Paragraph IV of the second section of the Notice exempts "Registered directors, registered partners, registered shareholders, or beneficial owners who carry out lending to associated entities". Note that there is no need that the shareholder be a bona fide shareholder, as is the case for the equivalent exemption in respect of Part II of the LCF Law. [We consider that the use of the plural "entities" should be read to refer to a group and therefore "associated entities" can refer to whichever entity in the group they are employed by – so the registered directors, registered partners, registered shareholders, or beneficial owners who make the loan do not have to be the registered directors, registered partners, registered shareholders, or beneficial owners of the entity to which they make the loan.

[1] Note that such shareholder loans will only qualify for the exemption where it is clear that the borrowers are bona fide shareholders of the entity i.e., that the shareholding has not been created solely for the purpose of the extension of credit.

[2] Note that such shareholder loans will only qualify for the exemption where it is clear that the borrowers are bona fide shareholders of the entity i.e., that the shareholding has not been created solely for the purpose of the extension of credit.